Comparison of UK and USA take home

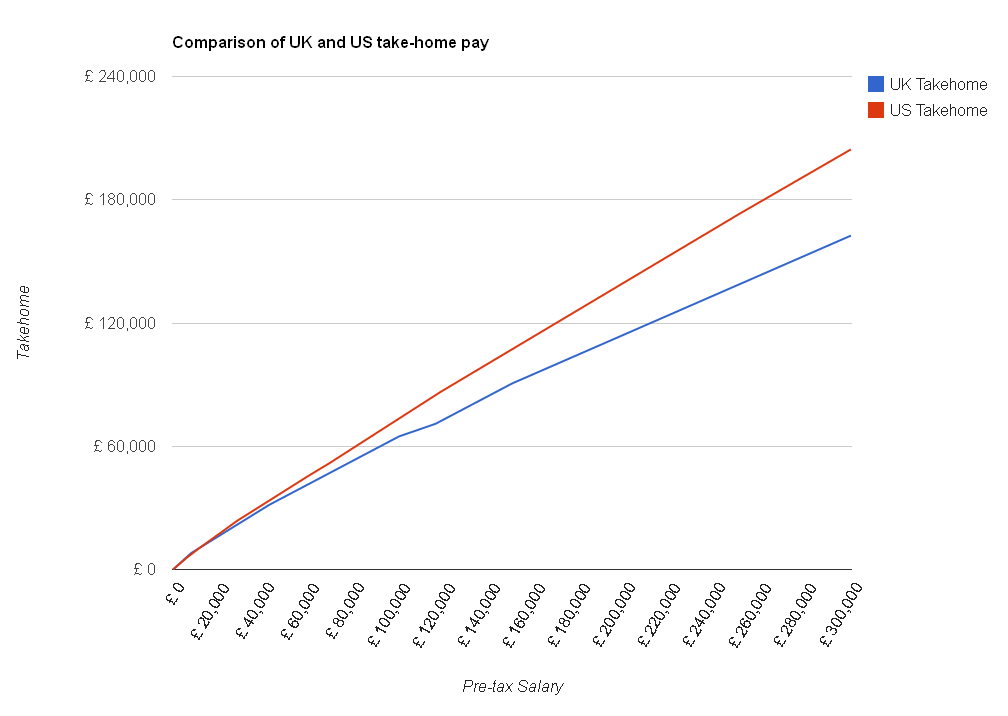

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

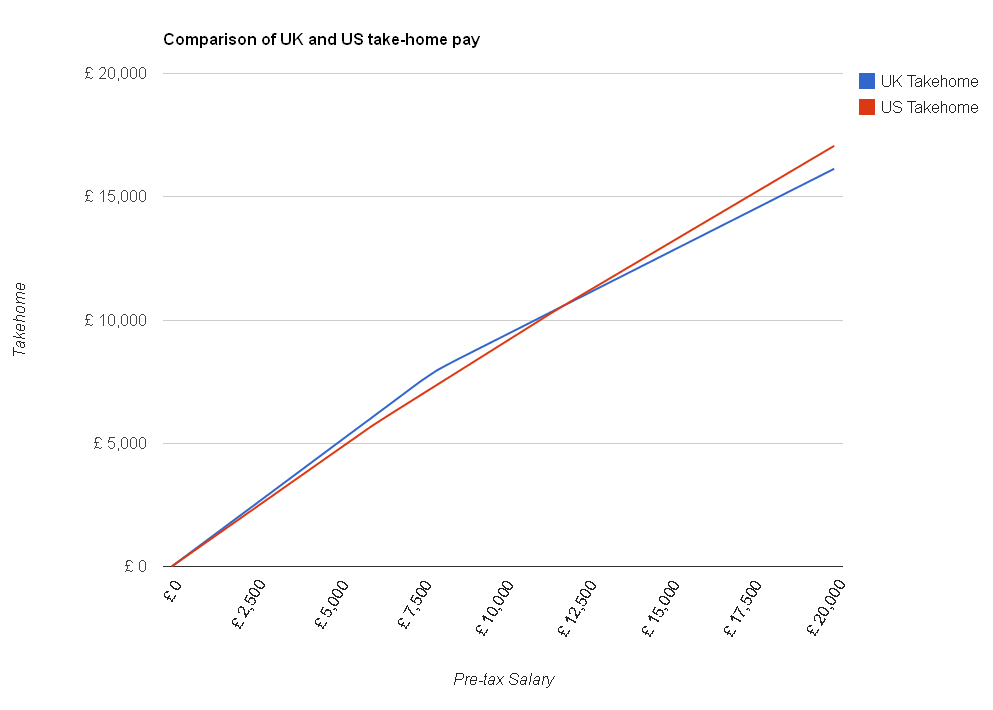

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

16 Comments to Comparison of UK and USA take home

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

us

VAT

Sponsored Links

Archive

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

Most Americans in those top tax brackets take large mortgage interest deductions, thereby significantly lowering their federal adjusted gross income. This and other deductions available in the US but not in the UK would push those lines much further apart.

As a Brit living in the US now I can confirm that my takehome pay is significantly higher here than it would be if I earned the same salary back home. Plus I live in Texas so there’s no additional state tax to pay, my company provides excellent health insurance, and the company pension plan + 401K actually adds up to more investment in my retirement than the company pension plan I left in the UK.

I guess I’ve been lucky on the benefits package I receive as I know a lot of others in the US don’t get anywhere near the health or retirement benefits I do.

None of these benefits every truly outweigh the lack of a good cuppa though.

I’m a Brit and have lived in US for 34 yrs. I left a job in UK that offered 20 days paid leave and cushy hours. I came here and took various unskilled jobs that had no health insurance and offered one week of UNpaid leave after a year! I was fired from a job for asking for two weeks off to visit UK, saying they couldn’t hold my job open. If you have a degree and a good job with benefits, you will keep more of your money in US. However, if you work less than 40 hours a week at any unskilled or semi-skilled job, you will not receive health benefits, and that’s if they are offered. Americans work long hours and take short vacations and in my opinion do not have as good a quality of life as Brits. I intend to move back one day.

Sue Russell. Things have changed here in the UK in the last 34 years dramatically! Unskilled and even semi skilled people are working full time hours plus to get by. Many people here are exempt from benefits and sick pay. I am working around the clock living with people with disabilities which I get free rent..otherwise would need to work 70 plus hours a week hard work.

This tax comparison doesn’t look at the problem deeply enough.

I employ several English people in the USA. Their standard of living in the USA is massively higher than the level they enjoyed in the UK. On good salaries, they live as only really wealthy people can in the UK.

One lives in a $600,000 property with 10 acres of land 5 minutes from a large town with all amenities. He tells me that his effective rate of income tax in the USA is 11% because of all the permitted deductions. This property would cost over £2 Million in the UK – a sum he could never afford.

Another lives in a large $350,000 house that is massively better than the nasty over crowded one bathroom ex-council house he and his family rented in the UK. He told me that the very best thing he ever did was to move to the USA.

In the part of the USA where I operate my business, I have met many British people absolutely terrified that their immigration status might change and they would we forced to return to the Socialist paradise that is the UK.

I will always pick the UK over the US any day. We have the NHS so I couldn’t care less how much I’m being taxed, I get free health care so tax me as much as you like.

But this doesn’t include state income tax. Which 43/50 American states have. The UK has no regional income taxes.

The UK does have a regional property tax (council tax) in the UK would fall between 1300USD and 3900USD, depending on the value of your home. Looking at property taxes in the USA, the average payer seems to fall between 1000USD and 3000USD depending on the state.

Really if you look at how much better the public infrastructure is in the UK and how much more generous the social spending is, American taxpayers are getting doubly screwed.

What the article fails to mention is that state income tax in the US is deductible from your federal income tax and if you happen to live in a state without income tax, you can deduct a certain percentage of your income to offset state sales tax.

Property taxes in the US run between 1 and 2 percent of the value of the home and, like many other things, they are deductible from your federal income tax. If you add the cost of health insurance to our income tax, my wife and I pay between 18 and 20 percent on a household income of around $430k (salaries are generally higher here and most goods are cheaper).

We moved from Canada about 12 years ago and the difference in our disposable income was crazy.

Corey W. I love it. “Free” healthcare that you pay 3 times over for the cost of my premiums and deductible combined. At $66,000 a year income my effective federal tax rate is about 8.8% state tax about 2% and Social Security and Medicare about 8%. For a total tax rate of 18.8% figure in the cost of all medical expenses in if I used them all my total % would go to about 29%. I bet you pay way more for your “Free Insurance”

‘What the article fails to mention is that state income tax in the US is deductible from your federal income tax and if you happen to live in a state without income tax, you can deduct a certain percentage of your income to offset state sales tax.’

No longer

https://www.washingtonpost.com/news/volokh-conspiracy/wp/2017/12/04/now-that-state-income-taxes-arent-going-to-be-deductible-will-states-switch-to-payroll-tax/?noredirect=on&utm_term=.82d4681ab37e

Also as the article described it wasn’t a true deduction. You paid your state taxes on your original salary, then pay federal taxes on your remaining salary.

You still get lumped with paying two income taxes.

That was the good old days though. Now you get the joy of paying twice with no deductions.

Ken-29% plus $400 monthly health insurance employer deduction plus $5000 health insurance deductible. And dont forget real estate tax $300 a month. Total of min $14000 to your 29% oh plus dental insurance plus vision.

Ken, what you’ve said is pure BS. Last year, at Bernie Sanders’ town hall, he had a businessman on stage who, for his 180 employees, paid out $2.4million for their health insurance. Following that, I did a check and in the UK his national insurance bill would be a “mere” $200,000. A TENTH of the cost. The average American household spends $12,000 annually on healthcare. That’s more than most Brits pay in taxes throughout the year. The United States’ current system is wasteful in the extreme. Medicare costs FIVE TIMES the budget of the entire NHS and yet provides coverage to fewer people.

Incidentally, it’s not other nations that have high tax rates. It’s the US that has ridiculously low “effective” tax rates, although several of those loopholes for ordinary people have now been closed by the Trump tax cuts for the wealthy. A nation needs money for infrastructure. It’s why I read of American infrastructure crumbling due to lack of investment. You’re the ones that keep saying “you don’t get something for nothing” while at the same time expecting the government to pay for things that you need but aren’t willing to pay for.

While yes–our State does charge some tax—it amounts to less than $30.00 per month. We have nearly paid off our home–a 1580 sq ft 3/2 bath –the basic with a fireplace and 2 car garage & bonus room. It as with all other homes in our area has a block wall around the back. We paid a mere $72,000. for this home–Just north of Los Angles.I can be at the beach in 2 hours- the snow in 45 minutes or the river in an hour and a half. Yet not deal with massive populations. We pay only $25 to see our doctor IF we go. Have the $1200 deductible IF we need any surgery or hospital stays. That works out to sending a $100 per month payment to whom ever I would owe IF need be.Rather than having a huge chunk taken out of our pay–just in case. That is what our employer healthcare benefits are there for. Also was able to purchase 10 acres of land with it’s own well–for $20,000–within 12 miles of town. THAT is something very difficult to pull off in the UK. There is NOT enough TEA–to make up for such low prices. My Great Grandmother left the UK over 116 years ago. Came to the U.S. –married a judge–tho from what I am told–SHE ruled over that household.

Most of what has been said about the US is very true. I have lived and worked in both countries. The US is far ahead of the UK on any economic metric I can think of. I have worked as an employee and now employ people. Sorry to say this, the UK is like a dungeon compared to the US, unless probably you are on benefit in the UK or about to die.

I’m seeing a lot of fantasy here. I haved lived in the UK now for 12 years, citizen as well. The US is great at the “nickel and dime” model. Sure you may have more disposable income but across the board for everything it costs more: Utilities, Mobile phones, property tax, Insurance deductibles, Cable TV, you need to own two cars or more because you have no mass transportation! I know Americans have an insatiable need to always be better or to justify why their “mousetrap” is the best. It’s not. I know first hand from the experience of living in the UK. Better schools as well, the British School system is miles ahead of the US and our kids aren’t getting gunned down in the hallways! I have found it cheaper living in the UK even London, we didn’t need to own 2 cars saving $20,000 or more a year! Keep your CheezWhiz and Guns, I’ll take Europe any day.