National Insurance

Childcare Vouchers added!

The Salary Calculator has been updated with a new option for Childcare Vouchers. Some employers offer employees the opportunity to have some of their pay in the form of vouchers which can be exchanged with accredited childcare providers instead of cash. These vouchers can be taken tax-free, saving the employee money.

Childcare vouchers are subtracted from your salary before tax and National Insurance, like pension contributions. However, there is a limit to the amount that can be taken tax-free each year – for the current tax year, this amount is £2,915. You can receive childcare vouchers above this amount, but you will not get the tax benefits. If you signed up for the voucher scheme before 6th April 2011, this limit applies no matter how much you earn. However, if you joined the scheme after this date and pay tax above the 20% Basic Rate, the amount you can receive tax-free is reduced. For those paying 40% tax (typically earning £42,475 or more), the tax-free allowance for childcare vouchers is £1,484 – and for those paying 50% tax (earning over £150,000) it is just £1,166.

To see how childcare vouchers can affect your take-home pay, head over to The Salary Calculator and enter your salary, along with the value of vouchers you receive each month. If you joined the scheme before 6th April 2011, tick the box to this effect. Enter the rest of your details and click Go! to see the results.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

What would a 30% flat tax be like?

Earlier this month, the 2020 Tax Commission published a report promoting replacement of our current income tax system, which has varying rates of tax (from 20% to 50%) and National Insurance (typically 12% and 2%), with a simpler system which has a single flat tax at a rate of 30%. They also recommended raising the personal allowance (the amount you can earn tax-free) to £10,000 per year, from its current £8,105.

I thought it would be interesting to see how this plan, if implemented, would affect us when we get paid each month. The following chart compares the April 2012 tax rates in blue with the simplified version in red:

As you can see, under this proposal everyone who currently pays tax on employment would take home more money each month, as the total amount due would be less. The 2020 Tax Commission say that as part of this plan, schemes that currently allow people to take income through a business, avoiding National Insurance, would be removed. This might mean that people who are using such schemes to avoid tax at the moment would pay more under the proposal.

But, as you’ve probably realised, if (almost) everyone is paying less tax, that means the Government will get less money. This is indeed true – the gap between the two lines on the chart represents how much less the Government would get each year – and the commission also recommend abolishing inheritance tax and similar taxes, which would further reduce Government income. This would mean further cuts in public spending – which would be difficult to swallow at the moment. More reaction on the report is in this useful BBC article.

National Insurance refunds

I mentioned last month that The Salary Calculator has a sister site called Employed and Self Employed, which helps with tax and National Insurance calculations if you are both employed and self-employed at the same time (or in the same tax year).

The calculations can get quite complicated and how much you earn in employment affects how much tax and National Insurance you should pay on your self employment. In researching for this site, I discovered that it can be quite easy to pay too much National Insurance on your self employment income if you don’t know about the details of the regulations and if you assume that because you fill in your tax return with both incomes, it will be calculated correctly. This occurs because the National Insurance you pay on employment income (Class 1) is different from the National Insurance you pay on self-employment income (Class 4).

In both Classes of National Insurance, you pay nothing below a certain threshold, a higher “main” rate between that threshold and an upper threshold, and a lower “additional” rate above that threshold. If you are employed and self employed at the same time, you can end up paying a lot of the “main” rate on both of your incomes, whereas if you earned the same amount just from either employment or self employment, some of your income would be charged only the lower “additional” rate of National Insurance. Fortunately, HMRC know this and they will, if requested, take into account any National Insurance you paid through your employment when working out how much you owe them for self-employment. Unfortunately, they won’t do this by default – you need to ask for it.

This is done by applying for exemption of Class 4 National Insurance contributions. This doesn’t mean you pay no Class 4 (unfortunately!), it just means that they will take into account how much Class 1 you have paid when working out how much Class 4 to charge you. If you don’t apply for exemption, they will charge you the standard amount, which might be more than you owe. Luckily, you can apply for a refund if you have overpaid in previous tax years (although not normally until 1st February the year after you overpaid). As a rule of thumb, if each of your employed and self-employed incomes were more than the lower NI threshold (£7,605 for the 2012/13 tax year) and the total of the two incomes was close to or more than the upper NI threshold (£42,475 for the 2012/13 tax year), you might be due a refund.

To make this easier, there is a new calculator on Employed and Self Employed which will help you work out if you might be due a National Insurance refund. Choose the tax year you’d like to check (as far back as 2005 / 6 – the thresholds were lower in previous years), enter your employment income and self-employment profit for that year, and the amount of Class 4 National Insurance you paid that year. The calculator will compare that with what it expects you to have owed for that year, and will let you know if a refund might be due. There are details on that page for how to contact HMRC and how to claim the refund. The calculator will do its best with the data you provide but it might not agree exactly with HMRC’s calculations – it can be used as an indicator and HMRC will be able to confirm whether or not a refund is due.

Good luck!

Employed and Self Employed

The Salary Calculator attempts to show you your take home pay after tax, National Insurance, pension deductions and Student Loan repayments – based on the assumption that you are an employee, and your employer will be making these deductions from your payslip by Pay As You Earn (PAYE). However, if you are self employed, tax and National Insurance is calculated differently, and you have to tell HMRC about your income, and then pay them what you owe directly.

If you are both employed and self employed at the same time, or change from employment to self employment during the tax year, your tax liability can be quite complicated. Your employment income will have been taxed by your employer, but the amount of self employment tax and National Insurance you pay will be affected by how much you have already paid through normal employment.

A new sister site for The Salary Calculator has been launched to try to help in this situation. Simply called Employed and Self Employed, there is plenty of information available and links to details from HMRC. There is also a complex tax calculator which will try to estimate your tax liability based on the information you provide.

Tax and National Insurance details which take effect from 6th April 2012 are applied, although previous tax years from 2009 onwards are also available for calculations (including the current 2011 tax year). If you are interested in the figures involved, you can check out the details page which contains detailed information from HMRC.

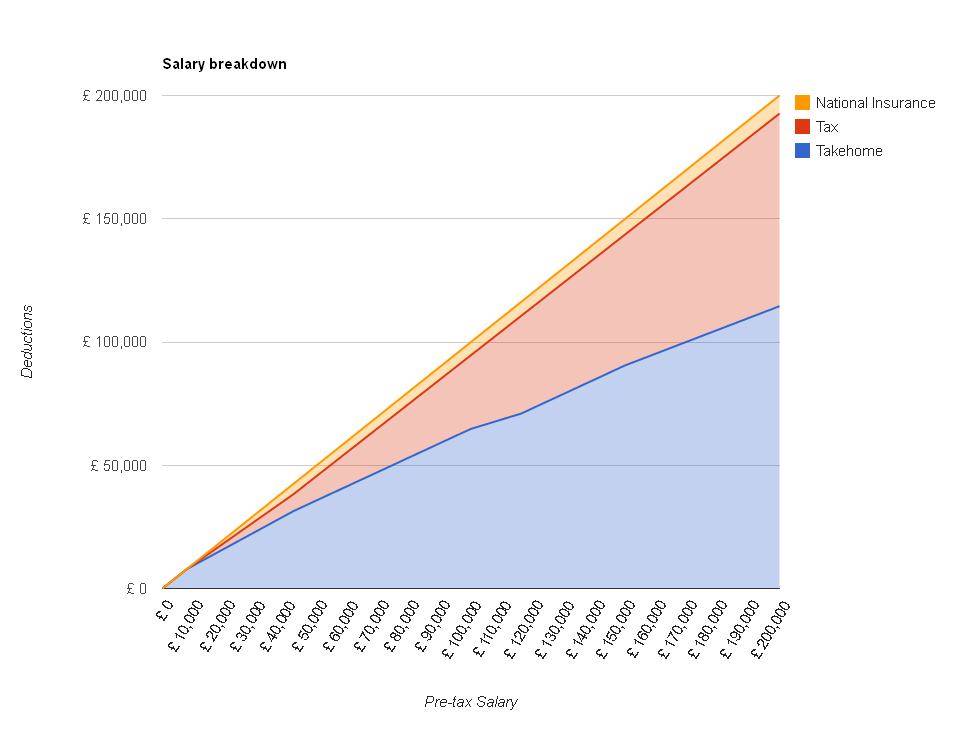

Visualisation of salary deductions

Following the update of The Salary Calculator to April 2012 tax rates, I thought it might be interesting to see how the proportion of your salary eaten up by income tax and National Insurance changes as you earn more money. If you earn less than £8,105 you pay no tax and less than £7,605 you pay no National Insurance. But those earning more than £150,000 per year will be losing nearly half their income to the tax man. I created the following chart showing how your take-home pay increases as your salary increases from £0 to £200,000:

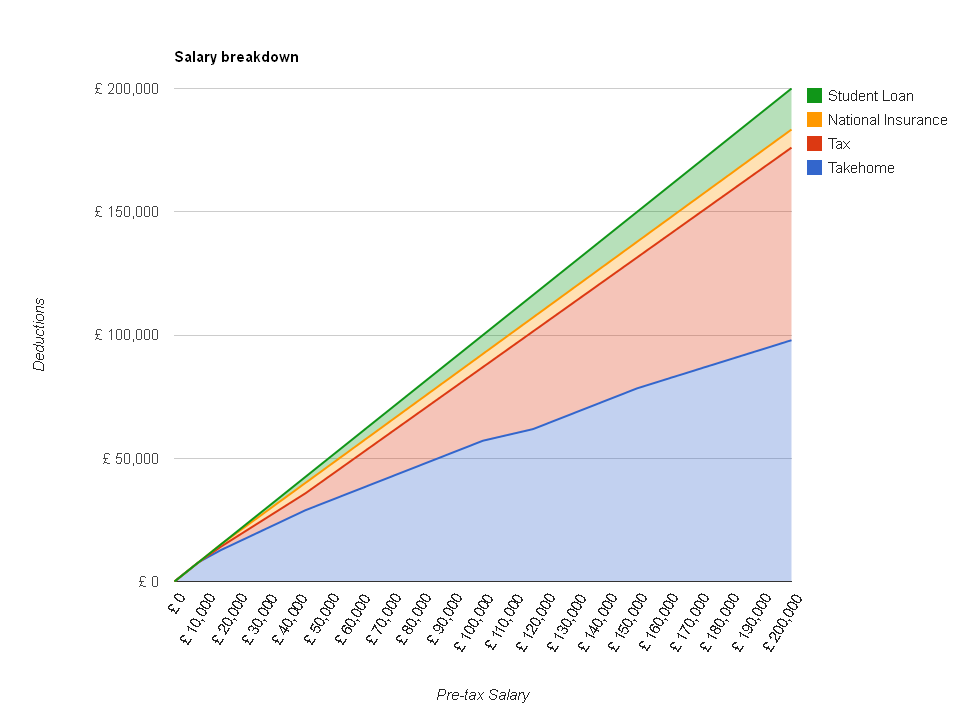

Take home is in blue – the red section on top is the tax you pay, and the yellow section on top of that is National Insurance. For those of you paying off your student loan, here is a version with those deductions on top, in green:

So you can see that as your salary goes up, your take-home pay (the blue line) always increases… but the higher your salary is, the slower your take-home pay increases with each pay rise, as more of it is going to the government.

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

us

VAT

Sponsored Links

Archive

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009