Foreign Currency

Foreign currency and exchange rates in 2022

After two years of lockdowns and travel restrictions, many will be looking at summer 2022 as the opportunity to finally escape and go on the holiday they’ve dreamt of for so long. That said, when it comes to travelling abroad, there’s a lot of factors to consider – one of them being foreign currency.

Perhaps you’re a little rusty when it comes to exchange rates, or maybe it’s the first time you’re leaving the country; after all, nearly a quarter of Brits have never been on a plane, and one in ten have never left the UK. Whatever the reason, if you’ve got questions about foreign currency, at The Salary Calculator, we’re here to answer all your burning questions. In this article, we’ll explain:

- How the pound is looking against the euro and the dollar

- Whether you should buy foreign currency in advance and what the risks are

- Top tips for securing the best exchange rate and avoiding charges

The pound versus the euro and the dollar

Exchange rates are in constant fluctuation, and a wide range of factors can affect them. Everything from political stability, interest rates and inflation to public debt, speculation and money supply can make a currency go up or down in value.

When it comes to the GBP/USD rate, over the last five years, it has been as high as $1.4328 and as low as $1.1492. That said, currently, the exchange rate is closer to the top-end of the trading range, and the higher it is, the cheaper it is to buy dollars with pounds.

Meanwhile, the GBP/ EUR rate, in 2021 and the beginning of 2022, has also been trading at the high end of its 5-year trading range.

Buying currency ahead of time: The advantages and risks

In some situations, when buying currency, it can be advantageous to plan ahead of time. In cases where you want to exchange large amounts of money, or you’re looking to purchase a currency that’s slightly more obscure than the euro or dollar where the exchange operator may have to order it in, buying in advance could be a good idea. That said, for ‘exotic currency,’ waiting until you arrive at your destination could be a better idea, as local rates are usually better.

You may also be thinking about buying your currency ahead of time in case the pound weakens. However, it’s important to keep your finger on the pulse when it comes to buying currency and check for updates on the exchange market. This can be done at XE.com, where you’ll be able to access live updates on the pound’s value against other currencies. Starting this research around a month before you’re due to head off is a wise idea. If, for example, you notice a trend of the rate steadily going down, buying then and there could help you get the most from your money. A safer bet, though, is to buy half of your travel money before and half later.

For trips where you’re unlikely to need to use cash, to avoid this altogether, it might be worth using a no foreign transaction fee travel card to pay for your purchases.

Tips for getting the best exchange rate and avoiding charges

There are some dos and don’ts when it comes to exchange rates and foreign currency, and below are some of our top tips.

Don’t buy currency at the airport

This is the number one way you will lose out when buying currency. Airport kiosks offer the worst holiday money exchange rates across the board, and they do this because they’re charging you for the convenience. If you’re up against time, or perhaps your trip is a spur of the moment escape, ordering your currency online and picking it up at the airport will help you avoid terrible exchange rates.

When abroad, pay in the local currency

Once you’ve flown to your holiday destination, make sure, when given the option, you choose to pay for purchases in the local currency. This will allow you to avoid both poor exchange rates and currency conversion fees.

Make sure to shop around

There are lots of foreign currency providers in the UK, so it’s worth comparing rates, even if the difference in exchange rates isn’t huge, you can still save a little.

Avoid using your credit or debit card for purchases abroad

When you use your card abroad, it’s likely your bank will charge you a non-sterling transaction fee (usually around 2-3%). Alongside this, you may be hit with additional fees for withdrawing cash and interest on top of the withdrawal. Some cards charge between 50p and £1.50 for transactions on top of their normal exchange rate charge. Banks who are the culprits for this include Lloyds, TSB and Halifax.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Comparison of UK and USA take home

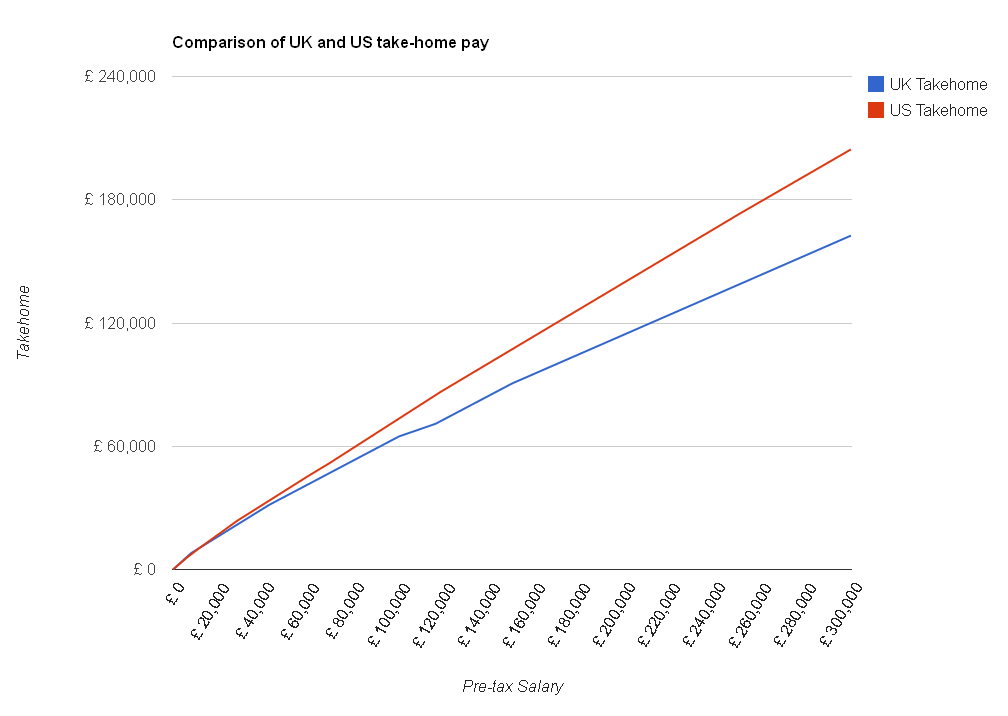

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

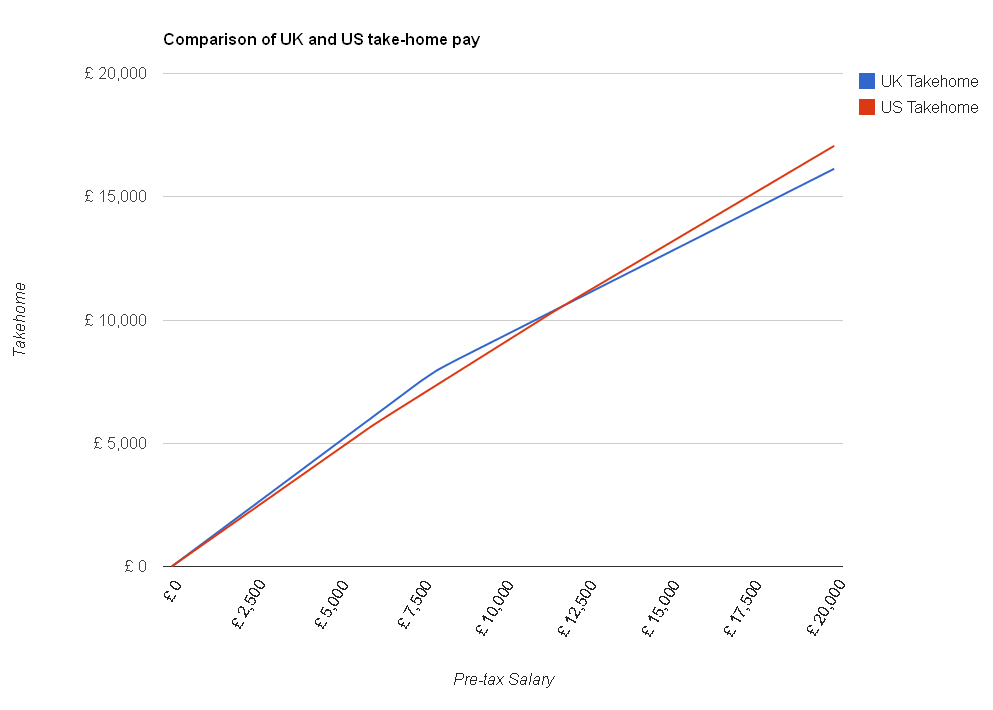

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

US tax can be complicated for same-sex couples

I was in the USA recently and was interested to see an article in the newspaper USA Today reporting that same-sex couples sometimes face extra difficulties when it comes to paying their taxes. In the US, although there is an equivalent to PAYE (where your employer deducts your tax for you), almost all taxpayers complete a tax return detailing their income, allowable deductions, and the tax they should pay. This might be more or less than what your employer deducted, so you may have to pay the difference or request a refund.

The problem for same-sex couples occurs because of two details of the American tax / legal system. Firstly, married couples can file a joint tax return, rather than filing two separate returns. Filing a return can be a laborious process, and sometimes it is necessary to pay a tax consultant to complete it for you, so filing only one can save time and money. Sometimes, filing a joint return actually leads to less tax being owed, an obvious benefit. Secondly, same-sex marriage is not recognised by the federal government (i.e. the country) but is recognised by some states (e.g. Massachusetts). What this all adds up to is same-sex couples having to file different tax returns at the state and federal levels – a joint return for their state (if it allows them to submit joint returns) and separate returns for the federal government. This can cost couples more in tax consultant fees (as there are more forms to submit) and can cost them more in tax as they miss out on the tax benefits of being a married couple.

At the moment it doesn’t appear that this problem is going to go away – not soon, in any case. You can learn more about US Federal Income Tax on the US Salary Calculator.

Holidaying in an overdrawn country

I’m in Greece at the moment, a country which has been suffering recently from severe economic problems. Over the past decade the government has taken advantage of the security of being part of the Euro and borrowed more than the country’s total annual revenue. The downturn lead to less advantageous borrowing rates, leaving the country with an increasingly difficult task to repay the loans (sounds like the “sub-prime” crisis but for countries rather than homeowners, doesn’t it?). Cuts in public sector pay and benefits have lead to protests and riots. So does this affect you if you’re visiting the country?

My experience is no. The weakened Euro has helped increase the number of visitors to Greece and its islands, where I am right now. Hotels and restaurants therefore are not short of customers and although I have seen a number of closed establishments, such businesses can fail even in boom times. Prices for meals and drinks remain reasonable – no sign of businesses using inflation to combat financial problems. There have also been no effects of any strikes, although if you were to be relying on public transport you may run out of luck (I have had no problem using the buses here, however).

The holiday resorts, bars, shops and tourist attractions have been as busy as ever and it doesn’t appear that the larger economic problems of the country are having an impact on the day-to-day experiences of a tourist enjoying the hospitality of a popular holiday destination.

Pound’s Euro rate improves

With the economy having improved over the last couple of months, and many people last year choosing to have a cheaper holiday and stay in the UK, perhaps this year there’ll be more of us thinking of treating ourselves to a trip to Europe this summer. And if you’re one of them, good news – over the last few weeks the Euro exchange rate has improved significantly!

Although €1.20 to the pound is not what you might consider a great rate, it’s not been at that level since the pound plummetted at the end of 2008. Unfortunately, it’s not all good news – this improvement is not due to the pound getting stronger but the Euro getting weaker – the pound continues to fall against the Yen and the Dollar (although it has seen a recent rally on this last count). The BBC’s Gavin Hewitt has written a great blog post explaining why the Euro is in such trouble.

When will the pound return to its previous strong position? Well, the rates we remember of a few years ago such as 2 dollars to the pound are not going to return anytime soon, but if confidence in the UK economy increases then investors will value the pound more. An increase in UK interest rates would also give a boost (since saving pounds then becomes more worthwhile) – but this would impact on mortgage interest rates for a lot of homeowners. Would you rather find it easier to pay your mortgage every month, or have a bit extra holiday money in the summer?

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

us

VAT

Sponsored Links

Archive

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009