Student Loan

April 2015 tax rates applied

From 6th April 2015, new tax thresholds and personal allowances will apply, and The Salary Calculator has been updated with these new values.

Although the default results are still for the current tax year, when you enter your details into the take home pay calculator, you will see a summary line at the bottom of the results showing how things will change from 6th April. Click on this line and you can see a side-by-side comparison of the 2014/15 and 2015/16 tax years, and a breakdown of how it will affect your take home pay. You can also choose 2015/16 in the tax year drop-down in the normal take home calculator.

The main change this year is an increase in the default personal allowance from £10,000 to £10,600 – which means you can earn an extra £600 without paying any income tax. The default tax code will change from 1000L to 1060L (if your tax code is different, it will probably change for next year to reflect the larger personal allowance). The Student Loan repayment threshold has also increased from £16,910 to £17,335, potentially saving those who are repaying their loans £38.25 per month (although this will also mean it takes longer to repay your loan).

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

A new beginning for 2015

As 2015 opens, it seems everyone I know is starting a new job! A common theme of conversations I’ve had is either promotions or moving jobs to a new company and new horizons. January is a popular time for people to make a fresh start, and what better way to do that than with a new job?

If you’re considering a move then The Salary Calculator is here to help – find out how much that new salary would bring home for you with the take home pay calculator, or even compare it side-by-side with your current salary with the salary comparison calculator. Maybe you’re thinking of improving your home life with a move to part-time work? The pro-rata salary calculator can help you see what would happen to your take-home if you reduced your hours in your current job.

Maybe 2015 for you is the year you go to university, or one in which you consider it. If this applies to you then I highly recommend Money Saving Expert’s page about the cost of university, and what those fees and loans mean – don’t make a decision about the cost of studying until you’ve read this guide, or at least watched the short video summary which appears just above point number 5.

Understanding student loans

I discovered an excellent article today by Martin Lewis, laying out the facts behind student loans – how they work and how they are repaid. There are a number of common misconceptions about student loans, and this article sets out all the information you would need to understand if you were considering going to university (or sending one of your children). Topics covered include:

- If you take a low paying job after graduation, you’ll only repay a small amount of the loan (or none of it!)

- Monthly repayments under the new loan system are lower than under the previous system

- Your monthly repayments are the same, no matter how high your tuition fees are

- You only start repaying once you leave university and start earning

- You will still be able to get a mortgage

To learn more about all of these and more, check out Student Loans Mythbusting.

You can see how much your student loan will cost each month, and how long it will take to repay, by using the tool on our sister site Loan Tutor.

Limited Company Tax Calculator added!

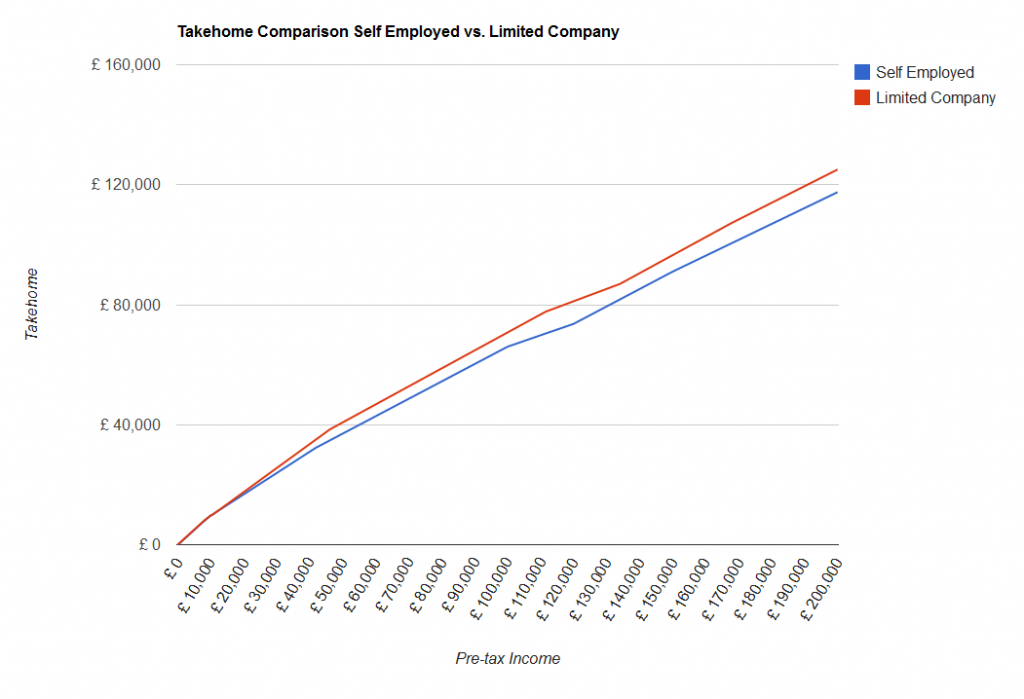

Over on our sister site Employed and Self Employed, we now have a Limited Company Tax Calculator. If you are self employed through a limited company (as many people, like IT contractors, can be), then your tax is worked out differently from if you are just plain-old self employed. The limited company pays you a salary, which is typically quite small, and the rest of the company’s profits are paid to you in dividends (after the company has paid corporation tax), which are taxed at different rates from other income. The following graph shows you a comparison of how much income you get to take home as self employed or with a limited company (click on the image for a larger version).

As you can see, in this example (with typical values entered), the limited company approach allows you to take home more of your income. However, this does come at a cost – more paperwork is required for limited companies, including registering with Companies House and having your books prepared by an accountant. Accountant’s fees might eat up a significant amount of the difference in take-home, so it might not be worth switching from one to another. If you’re interested in being self employed as a limited company, speak to an accountant to find out if it is right for you.

To start performing tax calculations, check out the limited company tax calculator over at Employed and Self Employed.

2014 Budget

Later today, the Chancellor will deliver his 2014 Budget to parliament, setting out his plans for the next few years. The Budget is the Chancellor’s opportunity to explain his policies and how they will affect the economy as a whole, and also what differences will be felt by ordinary members of the public.

He is likely to make much of the fact that the tax-free personal allowance (how much you can earn without paying income tax) has increased to £10,000 from April 2014, a coalition pledge delivered 1 year early. There is also talk that he might announce plans to raise the threshold for 40% tax (the amount at which you start paying income tax at 40% rather than 20%) in future years. This would probably lower the tax paid by those in middle management positions, say, and those in more senior roles.

The income tax and National Insurance rates which will take effect from 6th April 2014 have already been applied to The Salary Calculator, so you can easily see how your take home pay will be affected by the new tax year. You can also view a side-by-side comparison of 2013 and 2014 so you can see where the differences come from.

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009