Student Loan

Employed and Self Employed

The Salary Calculator attempts to show you your take home pay after tax, National Insurance, pension deductions and Student Loan repayments – based on the assumption that you are an employee, and your employer will be making these deductions from your payslip by Pay As You Earn (PAYE). However, if you are self employed, tax and National Insurance is calculated differently, and you have to tell HMRC about your income, and then pay them what you owe directly.

If you are both employed and self employed at the same time, or change from employment to self employment during the tax year, your tax liability can be quite complicated. Your employment income will have been taxed by your employer, but the amount of self employment tax and National Insurance you pay will be affected by how much you have already paid through normal employment.

A new sister site for The Salary Calculator has been launched to try to help in this situation. Simply called Employed and Self Employed, there is plenty of information available and links to details from HMRC. There is also a complex tax calculator which will try to estimate your tax liability based on the information you provide.

Tax and National Insurance details which take effect from 6th April 2012 are applied, although previous tax years from 2009 onwards are also available for calculations (including the current 2011 tax year). If you are interested in the figures involved, you can check out the details page which contains detailed information from HMRC.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Visualisation of salary deductions

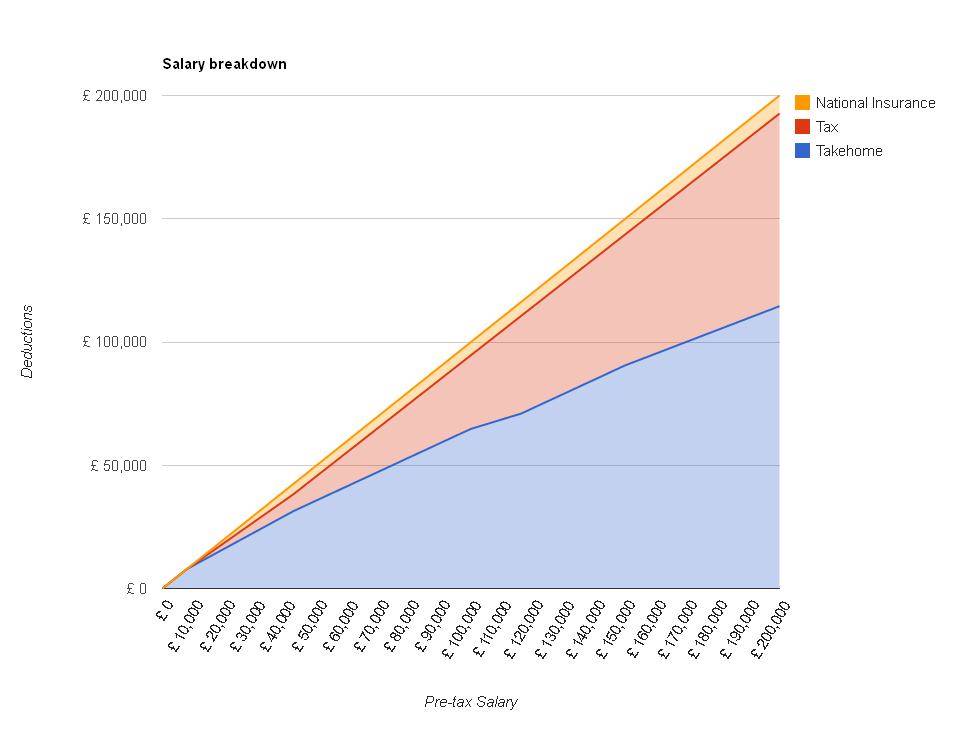

Following the update of The Salary Calculator to April 2012 tax rates, I thought it might be interesting to see how the proportion of your salary eaten up by income tax and National Insurance changes as you earn more money. If you earn less than £8,105 you pay no tax and less than £7,605 you pay no National Insurance. But those earning more than £150,000 per year will be losing nearly half their income to the tax man. I created the following chart showing how your take-home pay increases as your salary increases from £0 to £200,000:

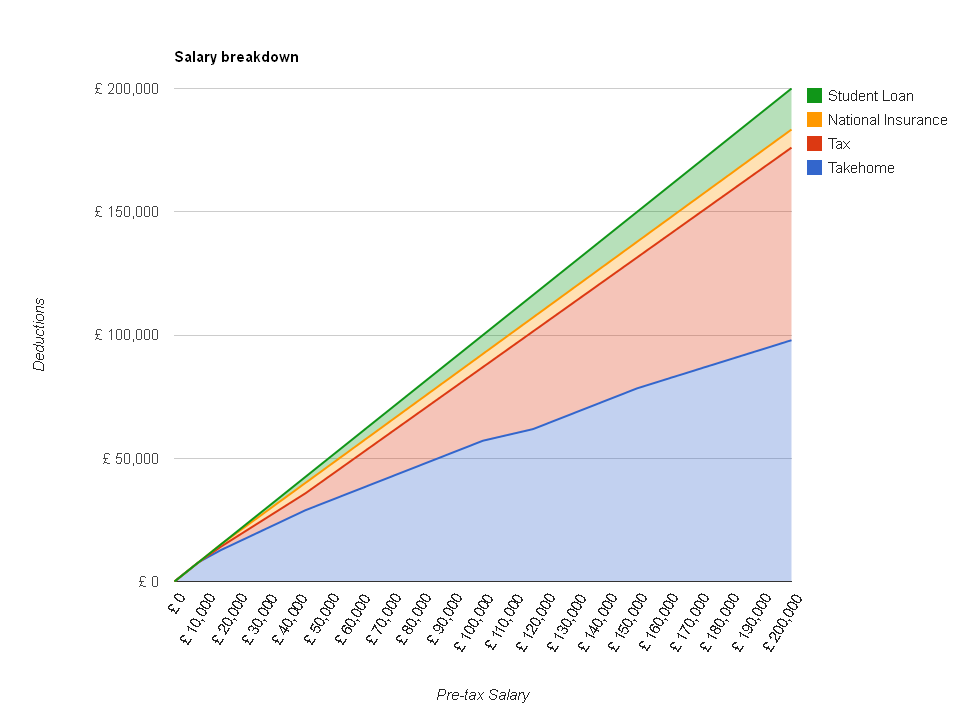

Take home is in blue – the red section on top is the tax you pay, and the yellow section on top of that is National Insurance. For those of you paying off your student loan, here is a version with those deductions on top, in green:

So you can see that as your salary goes up, your take-home pay (the blue line) always increases… but the higher your salary is, the slower your take-home pay increases with each pay rise, as more of it is going to the government.

Bonus payments added!

As requested by a large number of visitors to the site, The Salary Calculator has been updated to allow you to enter bonus payments. If you might earn a bonus from your employer one month, you can now use the calculator to see what kind of a difference it will make to your payslip that month.

Bonuses are typically paid as a one-off extra on top of your usual salary. Your employer will work out what extra deductions (tax, National Insurance and Student Loan) will be required that tax year because of this extra payment, and will add these on top of your usual deductions for that month. Yes, this unfortunately means that you’ll pay a lot of tax, NI and Student Loan that month (boo!) – but some of your bonus will be left for you to enjoy!

For the purposes of displaying the information The Salary Calculator assumes that your salary is normally paid monthly, and shows you what a bonus month would look like compared to a normal month. Similar calculations will be done by your employer if you are paid weekly. To get started, click here to check out The Salary Calculator with bonus payments.

April 2011 rates applied

The April 2011 tax and National Insurance rates have been applied to The Salary Calculator.

In comparison to last year, when rates for most of us were unchanged, there are a number of differences which will mean that your payslip will be different next month.

The standard personal allowance (the amount you can earn tax-free) is increasing by a thousand pounds to £7,475, but this is mitigated in some way for higher earners by the threshold for 40% tax being lowered to £35,000. Similarly, NI rates increased by one penny in the pound (to 12% and 2%) but the threshold for paying NI increased so lower earners may not be too badly affected.

To see how you’re affected, try out The Salary Calculator with your salary. The details of the figures used by The Salary Calculator are available on the About page.

Useful links:

Student Loan over-repayment

As you might have heard on the news or read in this article, £15 million has been overpaid this year by former students repaying their student loan – because the repayments have continued to be taken even after the full amount of the loan has been paid back.

The problem occurs because although the Student Loans Company (SLC) has informed your employer through HMRC that you should have student loan deducted from your payslip each month, the SLC doesn’t know how much is being repaid until the end of the tax year when your employer files its tax return. As you’ll see on the About page of The Salary Calculator, student loans are repaid at a fixed rate of 9% of anything you earn over £15,000 – no matter how large (or small) the balance of the loan. If you are close to repaying the total of your loan, deductions may continue for some time until the SLC realise that you have overpaid – and even then, they have to communicate to HMRC who then pass the “stop” message on to your employer.

There are things you can do to help prevent overpayment, however. The Student Loan Repayment Portal (which appears currently to be unavailable) will show the last known balance of your account, and allows you to enter information from your payslips to estimate how much is outstanding. If you are close to repaying the full amount, you can contact the SLC directly and pay off the remaining balance by debit card over the phone. When you do this you will need to make sure that the stop notice makes its way from the SLC through HMRC to your employer – if not, you will find the deductions continue to be taken even though you have repaid the loan. You may be able to get the SLC to fax confirmation of the stop directly to your employer, making sure it arrives in time for your next payslip – if you speak to the SLC about repaying your loan, you can ask them about this and discuss it with your employer.

Alternatively, you can arrange for your remaining balance to be taken by Direct Debit rather than by PAYE deduction – meaning that when the balance has been repaid in full, the debits stop automatically. Again, the SLC need to send a “stop” note to HMRC and your employer, but this happens before the amount is repaid and therefore if something goes wrong you are less likely to be trying to get a refund.

If you are repaying your student loan and you think this may apply to you, check out the Repayment Portal I linked to above and see how much is still outstanding on your loan. I repaid my loan earlier this year and I can tell you it is a good feeling!

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009