Income Tax

Visualisation of salary deductions

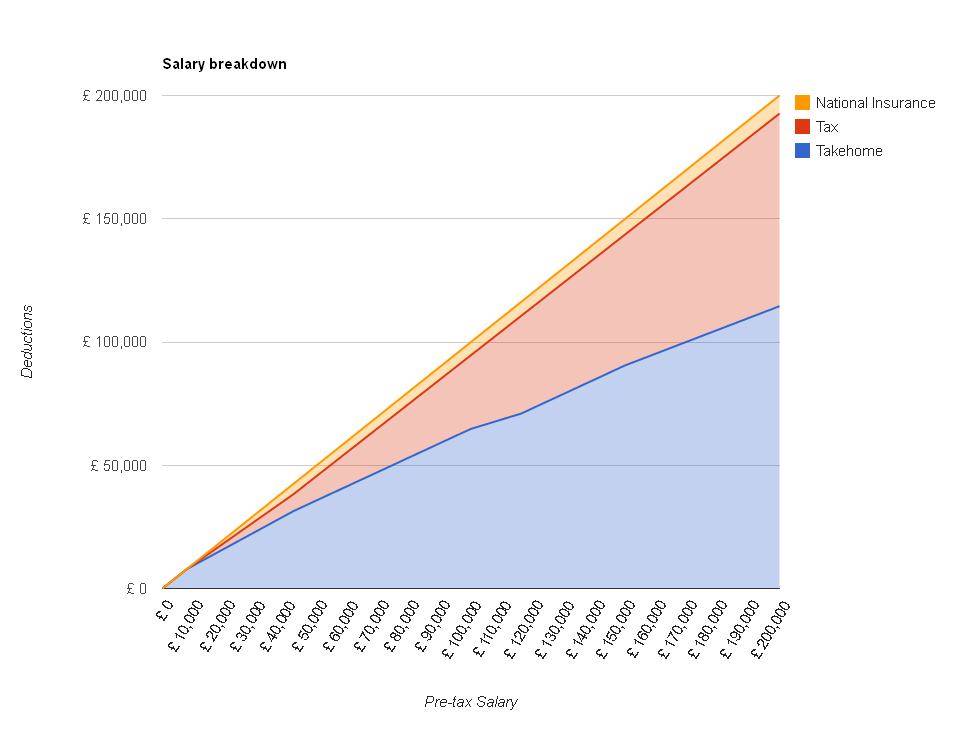

Following the update of The Salary Calculator to April 2012 tax rates, I thought it might be interesting to see how the proportion of your salary eaten up by income tax and National Insurance changes as you earn more money. If you earn less than £8,105 you pay no tax and less than £7,605 you pay no National Insurance. But those earning more than £150,000 per year will be losing nearly half their income to the tax man. I created the following chart showing how your take-home pay increases as your salary increases from £0 to £200,000:

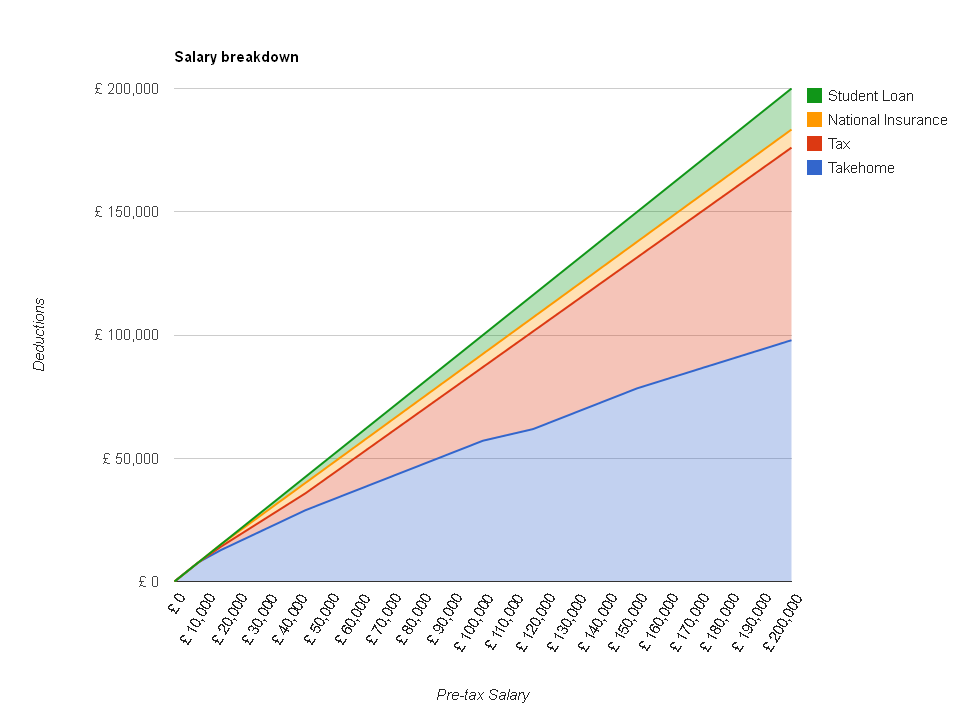

Take home is in blue – the red section on top is the tax you pay, and the yellow section on top of that is National Insurance. For those of you paying off your student loan, here is a version with those deductions on top, in green:

So you can see that as your salary goes up, your take-home pay (the blue line) always increases… but the higher your salary is, the slower your take-home pay increases with each pay rise, as more of it is going to the government.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

US tax can be complicated for same-sex couples

I was in the USA recently and was interested to see an article in the newspaper USA Today reporting that same-sex couples sometimes face extra difficulties when it comes to paying their taxes. In the US, although there is an equivalent to PAYE (where your employer deducts your tax for you), almost all taxpayers complete a tax return detailing their income, allowable deductions, and the tax they should pay. This might be more or less than what your employer deducted, so you may have to pay the difference or request a refund.

The problem for same-sex couples occurs because of two details of the American tax / legal system. Firstly, married couples can file a joint tax return, rather than filing two separate returns. Filing a return can be a laborious process, and sometimes it is necessary to pay a tax consultant to complete it for you, so filing only one can save time and money. Sometimes, filing a joint return actually leads to less tax being owed, an obvious benefit. Secondly, same-sex marriage is not recognised by the federal government (i.e. the country) but is recognised by some states (e.g. Massachusetts). What this all adds up to is same-sex couples having to file different tax returns at the state and federal levels – a joint return for their state (if it allows them to submit joint returns) and separate returns for the federal government. This can cost couples more in tax consultant fees (as there are more forms to submit) and can cost them more in tax as they miss out on the tax benefits of being a married couple.

At the moment it doesn’t appear that this problem is going to go away – not soon, in any case. You can learn more about US Federal Income Tax on the US Salary Calculator.

Raising the personal allowance

The personal allowance is the amount of money you are allowed to earn each year before you start paying income tax. As mentioned in a recent BBC article, Nick Clegg and the Liberal Democrats made an election pledge to raise the personal allowance to £10,000 (at the time of the election, the personal allowance was £6,475). As part of the coalition government the Conservatives and the Lib Dems agreed to make this increase before 2015, and last year the threshold was increased by £1,000 to £7,475 – although, as I reported at the time, the threshold for 40% tax was lowered at the same time so that those earning more would start paying 40% tax sooner.

This April, the standard allowance for the under-65s is set to increase again, this time to £8,105. This is less of an increase than last year (a change only of £630) but it will still make a significant difference to those on lower incomes. Nick Clegg is pushing for the threshold to be raised quicker than that, but the Conservatives are resisting it for now – the main reason for this being that the lost tax would have to be paid for elsewhere. This could mean either increasing other taxes or making further cuts.

The personal allowance is affected by your tax code, which means you may not receive the standard tax-free amount. More information about tax codes in this blog post.

The Salary Calculator will be updated in early Spring with the tax thresholds and rates for April 2012.

Bonus payments added!

As requested by a large number of visitors to the site, The Salary Calculator has been updated to allow you to enter bonus payments. If you might earn a bonus from your employer one month, you can now use the calculator to see what kind of a difference it will make to your payslip that month.

Bonuses are typically paid as a one-off extra on top of your usual salary. Your employer will work out what extra deductions (tax, National Insurance and Student Loan) will be required that tax year because of this extra payment, and will add these on top of your usual deductions for that month. Yes, this unfortunately means that you’ll pay a lot of tax, NI and Student Loan that month (boo!) – but some of your bonus will be left for you to enjoy!

For the purposes of displaying the information The Salary Calculator assumes that your salary is normally paid monthly, and shows you what a bonus month would look like compared to a normal month. Similar calculations will be done by your employer if you are paid weekly. To get started, click here to check out The Salary Calculator with bonus payments.

April 2011 rates applied

The April 2011 tax and National Insurance rates have been applied to The Salary Calculator.

In comparison to last year, when rates for most of us were unchanged, there are a number of differences which will mean that your payslip will be different next month.

The standard personal allowance (the amount you can earn tax-free) is increasing by a thousand pounds to £7,475, but this is mitigated in some way for higher earners by the threshold for 40% tax being lowered to £35,000. Similarly, NI rates increased by one penny in the pound (to 12% and 2%) but the threshold for paying NI increased so lower earners may not be too badly affected.

To see how you’re affected, try out The Salary Calculator with your salary. The details of the figures used by The Salary Calculator are available on the About page.

Useful links:

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

us

VAT

Sponsored Links

Archive

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009