50% tax

2019 General Election Calculator

A General Election is taking place in the UK on 12th December, and all the main parties have released their manifestos – most of which have some policies which would affect your take-home pay, if they were to be elected. It’s a small part of the puzzle, but to help you try to figure it out, the 2019 Election Calculator has been created – this attempts to show you what your take-home pay would look like if each party came to power.

Some parties have proposed only small changes, and others have much larger plans. The calculator has had to make some assumptions, as the parties don’t always provide all the detail – anything that isn’t specified in a manifesto has been left as it currently is.

It is also worth noting that the parties also have policies which affect other areas of tax (such as VAT, inheritance tax, capital gains tax etc), and other benefits such as free childcare, which means that your finances are likely to be affected by things not considered by this calculator. If you’d like to give it a go, please head over to the 2019 Election Calculator – and let me know if you think anything is missing!

Calculators from previous elections have been archived:

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

April 2013 tax rates applied to The Salary Calculator

The Salary Calculator has been updated with the latest income tax and National Insurance rates from HMRC which will take effect from 6th April 2013. Although for the moment the current 2012/13 tax year will be applied to calculations by default, you can choose the 2013/14 tax year from the drop-down box to see what your pay slip will look like later this year. You can also see a summary of the 2013/14 values under the normal results, and there is a special Comparison page where you can see 2012 and 2013 side-by-side.

The biggest changes for most people will probably be:

- Tax-free personal allowance increased from £8,105 to £9,440

- Student Loan repayment threshold increased from £15,795 to £16,365

- Additional rate tax for those earning over £150,000 reduced from 50% to 45%

- Over-65 and Over-75 personal allowances not increased

The last of these points was called the “Granny Tax” by detractors when it was first announced, although it is not actually an introduction of a new tax. Previously, those over 65 and over 75 had larger tax-free personal allowances which, like the Under-65 allowance, was increased each year. From April 2013, these allowances will no longer be increased each year and will remain at their current values of £10,500 and £10,660 respectively – until the Under-65 allowance catches up with them. Also, these allowances will no longer be applied to people reaching the qualifying age – only those who were born before 6th April 1948 (or 6th April 1938 for the upper allowance) will receive these allowances. Those reaching these threshold ages after 6th April 2013 will not receive the additional allowance.

Those who are fortunate enough to be earning more than £150,000 will see their tax rate on income over that limit reduced from 50% (where it has been since this tax was introduced in April 2010) to 45%. You might think that, with personal allowances going up and tax rates coming down, everyone will be better off from the start of the new tax year. However, there is a set of people who will find that they pay more tax in the 2013/14 tax year than they did in the 2012/13 tax year, due to a rule which applies to those earning over £100,000.

If you earn more than £100,000 in the year, the tax-free personal allowance is gradually reduced at a rate of £1 for each £2 you earn over the £100,000 limit. Those earning £118,880 or more in 2013/14 will therefore have no tax-free allowance. Because the threshold between 20% and 40% tax has been reduced, those who earn between about £117,000 and £157,000 will find that they actually pay more tax than they did the year before – when those earning less and those earning more will each pay less than they did the year before.

If you want to see how the April 2013 income tax rates will affect you, you can get started with The Salary Calculator or try the 2012 / 2013 Income Tax Comparison.

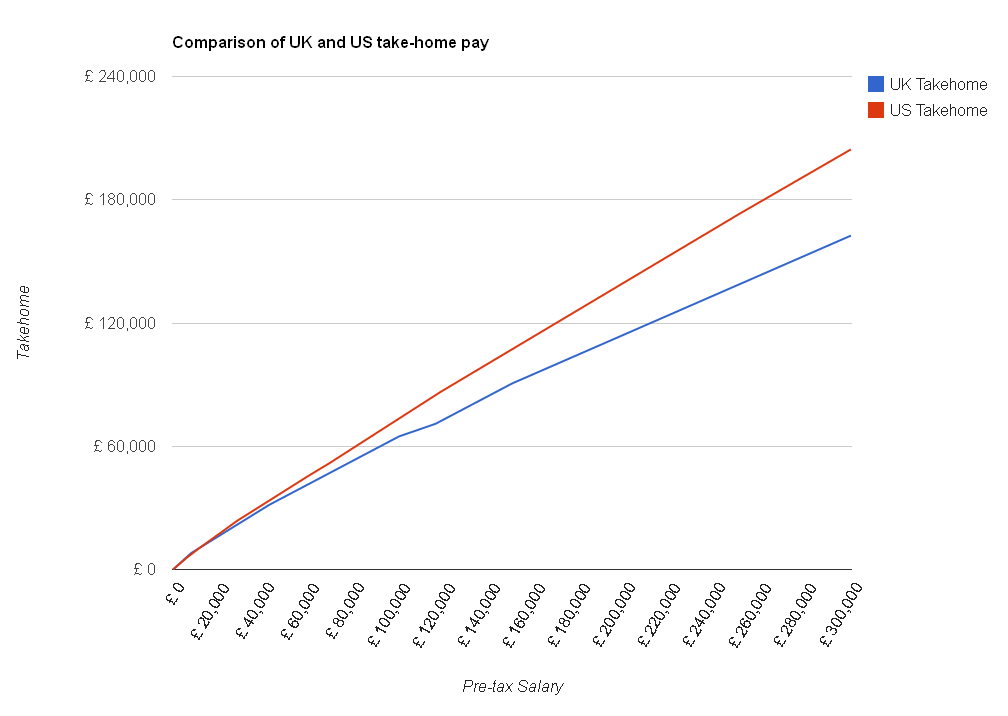

Comparison of UK and USA take home

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

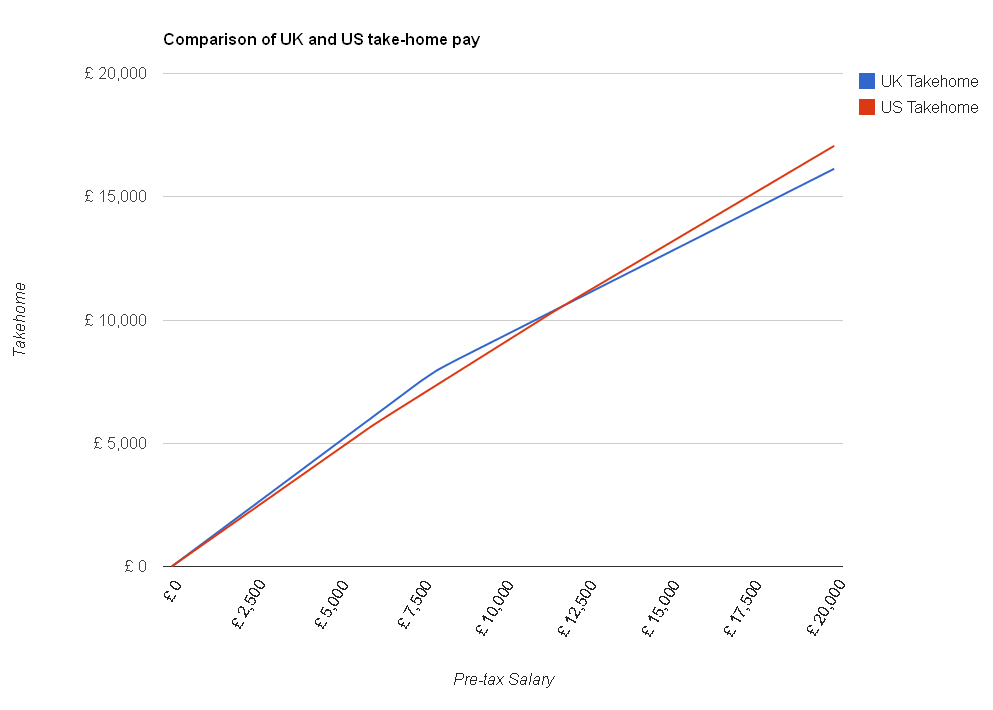

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

Budget 2012 update

Today, the Chancellor gave his annual budget speech in the House of Commons, outlining government spending plans for the next couple of years. The details of income tax and National Insurance from 6th April 2012 had already been provided, so as I have explained in a previous post, The Salary Calculator is up to date with the latest tax information.

However, the Chancellor took the opportunity to outline plans for income tax from April 2013, and there will be a few changes. Firstly, the under-65 tax free allowance will be increased from April 2013 to £9,205, in line with the coalition pledge to increase the tax-free personal allowance to £10,000 before the next election. This is an increase of £1,100 on the April 2012 value, saving those on low and middle incomes up to £220 per year. However, the increased personal allowances currently available to those over 65 will be frozen and, for those not yet receiving the increased allowances, replaced by a single allowance for all ages (although this change will not take immediate effect).

Another change in 2013 will be to reduce the top rate of income tax, paid by those earning over £150,000 per year, from 50% to 45%. The 50% rate was introduced by the Labour government, where previously such income would have been taxed at 40%. This will be popular with traditional Tory voters but Labour are complaining that the richest are getting tax cuts in this time of austerity.

The Salary Calculator will be updated with the April 2013 values nearer the time – in the meantime, you can see what the April 2012 changes will make to your pocket each month by checking The Salary Calculator 2012. There is also a comparison utility so you can easily see the difference between 2011 and 2012.

Election Comparison Calculator launched!

With a general election now called for 6th May, the major parties have started campaigning and promoting their policies. All have policies related to taxation, and The Salary Calculator has tried to show you what their different policies may mean to you.

The Election Comparison Calculator aims to help you see the differences between the major parties’ policies on personal income. Using the information available, the calculator estimates how their policies would affect your take home pay. As described on the Election Comparison Calculator page itself, not all the details are available at the moment, and probably won’t be until the next government holds its first budget. However, the details they have provided allow the calculator to estimate what those changes would mean to you.

All the details used to create the calculator are available underneath the results. As explained in that description, the calculator considers PAYE changes – each party also has other economic policies which may affect you in other ways, such as stamp duty or inheritance tax. Some assumptions have had to be made – if you can help provide more detailed information then please contact us. So why not try the Election Comparison Calculator and see what you learn?

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009