dollar

Comparison of UK and USA take home

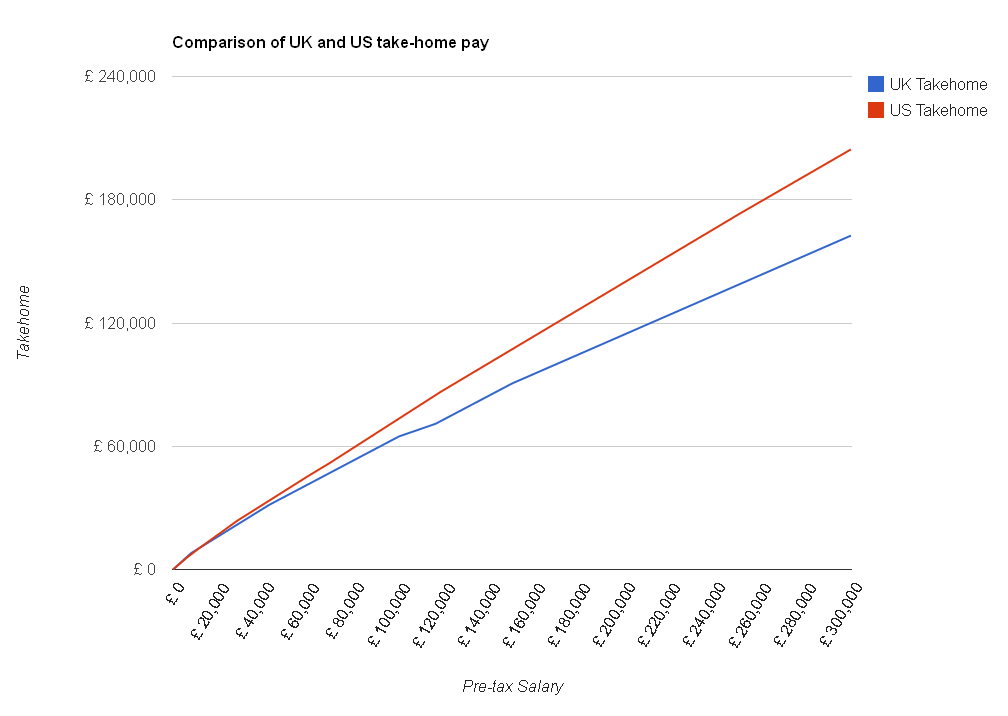

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

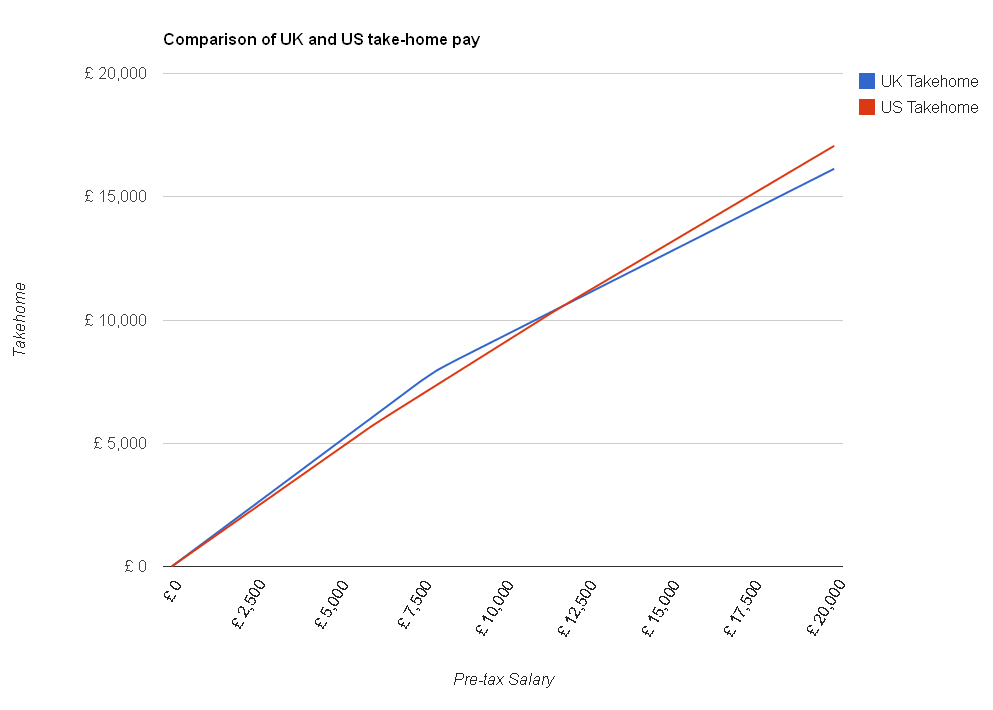

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Visualisation of large financial numbers

The well-known web comic xkcd has created a very detailed visualisation of what the large financial numbers, like millions and billions, actually mean. It’s sometimes difficult to comprehend exactly what it means when newsreaders mention a debt of £1 billion.

This visualisation is rather US-centric, but much of the information displayed is valuable for those of us on this side of the Atlantic. It starts with individual dollars, then compounds them to thousands (shrinking the scale). Continuing on to millions, billions and finally trillions, it gives a clear indication of just how much money we’re talking about. Check out the diagram here: http://xkcd.com/980/huge/ (you will need to zoom in!).

Pound’s Euro rate improves

With the economy having improved over the last couple of months, and many people last year choosing to have a cheaper holiday and stay in the UK, perhaps this year there’ll be more of us thinking of treating ourselves to a trip to Europe this summer. And if you’re one of them, good news – over the last few weeks the Euro exchange rate has improved significantly!

Although €1.20 to the pound is not what you might consider a great rate, it’s not been at that level since the pound plummetted at the end of 2008. Unfortunately, it’s not all good news – this improvement is not due to the pound getting stronger but the Euro getting weaker – the pound continues to fall against the Yen and the Dollar (although it has seen a recent rally on this last count). The BBC’s Gavin Hewitt has written a great blog post explaining why the Euro is in such trouble.

When will the pound return to its previous strong position? Well, the rates we remember of a few years ago such as 2 dollars to the pound are not going to return anytime soon, but if confidence in the UK economy increases then investors will value the pound more. An increase in UK interest rates would also give a boost (since saving pounds then becomes more worthwhile) – but this would impact on mortgage interest rates for a lot of homeowners. Would you rather find it easier to pay your mortgage every month, or have a bit extra holiday money in the summer?

Pound falling against the Euro

I have a trip to Paris coming up and it’s prompted me to check out the current exchange rate on the excellent X-Rates site. As you’ll see if you click on that link, Sterling has been falling over the last month or so.

As I wrote a few months ago, the Pound had improved both against the Euro and the Dollar during the summer months, which was good news for those of use on holiday there. It didn’t reach the highs of 2008, but it had improved since last winter. However, during August and particularly in September, a lot of the ground the Pound had made up was lost against both currencies. The pound is currently worth €1.09, from a high during the summer of €1.18, making travelling to Europe very expensive for us Brits.

I believe the reason for the Pound’s decline is the fact that the UK is still in recession whereas the powerhouses of Europe, Germany and France, have successfully grown their economies. Hopefully we will see in the next few months Britain exit from recession, and then the Pound will become a more attractive currency for investors, making it stronger and (importantly) worth more.

Healthcare in the USA

Another thing that is being mentioned a lot in the news in the States at the moment is universal healthcare. They don’t have an equivalent of the NHS that we have in the UK, to get healthcare in the US you need to have health insurance. Just as with car insurance or travel insurance, the more you pay the better coverage you get – the cheaper insurance policies will have high excesses (the amount you have to pay in the event of a claim) and may not cover all treatments.

The cost of insurance has been going up in recent years, and more and more Americans can’t afford to have any insurance at all. Small businesses are also finding it difficult to provide healthcare for their employees, as they can’t negotiate big discounts with healthcare providers. The number of Americans without insurance has been increasing, and although hard numbers are difficult to find (different organisations count the uninsured in different ways), this study claims that it could be as many as one in three are uninsured.

President Obama is pushing for healthcare reform which would cover all Americans with a government-run system, the cost of which is estimated at $611 billion. That’s a lot of money, and it could hit American taxpayers for years to come. However, it may end up costing them less than the private insurance route – as this Wikipedia article says, more is spent per person for healthcare in the US than in any other country – a centralised approach may be more efficient.

What relevance does this have for us in the UK? I believe that healthcare reform could help improve the US economy, and as I said in my last post, that will help bring the world out of recession. Why do I think this? Small businesses in the US are struggling in the current economic climate – they are having to cut healthcare benefits for their employees, or face increasing costs. Citizens with insurance spend less time being ill (as they get better treatment, or indeed any treatment, and also can take preventative measures like regular check-ups) and therefore take less time off work and are therefore more productive. With the burden of providing healthcare for employees lifted, small businesses and family-run businesses should be able to weather the storm of the global recession, and turn a profit sooner.

This is all assuming that the cost of medical insurance as it is currently is higher than the increased taxes that will be required for government healthcare to be provided. This is by no means certain, and of course, health insurance is optional but taxes are not!

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009