Jobs

A new beginning for 2015

As 2015 opens, it seems everyone I know is starting a new job! A common theme of conversations I’ve had is either promotions or moving jobs to a new company and new horizons. January is a popular time for people to make a fresh start, and what better way to do that than with a new job?

If you’re considering a move then The Salary Calculator is here to help – find out how much that new salary would bring home for you with the take home pay calculator, or even compare it side-by-side with your current salary with the salary comparison calculator. Maybe you’re thinking of improving your home life with a move to part-time work? The pro-rata salary calculator can help you see what would happen to your take-home if you reduced your hours in your current job.

Maybe 2015 for you is the year you go to university, or one in which you consider it. If this applies to you then I highly recommend Money Saving Expert’s page about the cost of university, and what those fees and loans mean – don’t make a decision about the cost of studying until you’ve read this guide, or at least watched the short video summary which appears just above point number 5.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

A fresh start in the New Year?

2014 has arrived, and for many people the start of a new year is a time to make a clean break with the past, and move on to new things. Often people join a gym, start a diet (after the excesses of the festive period!) – or look for a new job.

The new job could be a promotion at your current place of work, or a new opportunity elsewhere – and The Salary Calculator can help you as you consider your options. If you’re wondering what a new salary might mean for your monthly take-home, check it out on the take-home pay calculator. If you know how much you need each month and would like to know what kind of salary you should be looking for, try using the required salary calculator.

You might be considering supplementing your income not by getting a new job, but by being self-employed in your spare time. In which case, you can try out the tools at our sister site Employed and Self Employed, which will help you to see how your tax and National Insurance contributions will be affected by your additional income.

If you are making a new start in 2014, best of luck!

Your total tax bill for the year is…

Although The Salary Calculator helps you to see how much of your salary gets eaten up by income tax, National Insurance and other deductions, there are other ways in which the government gets its hands on your money. There’s council tax, for example. VAT on goods and services. And fuel duty on petrol and diesel.

The guys and girls at Money Sense, run by paydayloan.co.uk, have created an interactive tool that lets you see how much more tax you pay during the year through other means. Try out their tax calculator and see what percentage of your income goes to the government in one form or another.

Becoming self-employed rather than un-employed

I read an interesting article this morning on the BBC News website about the phenomenon of people who are unemployed deciding to become self-employed rather than keep looking for “traditional” employment. Apparently, a significant number of people have found that it is difficult to find a job, but that they have been able to start and run promising businesses themselves – something they have found much more fulfilling than taking Jobseeker’s Allowance.

Our sister site Employed and Self Employed has a tax calculator you can use to see how much tax and National Insurance would be deducted from self employment profits, if you are thinking of starting your own business. There is also a more complex calculator if you already have a job but are thinking of becoming self-employed in your spare time – you can work out how much of your profits you would be able to keep hold of.

If you are unemployed and thinking of starting your own business, you may be eligible for some funds from the government to help you get started. More information is available here about the New Enterprise Allowance.

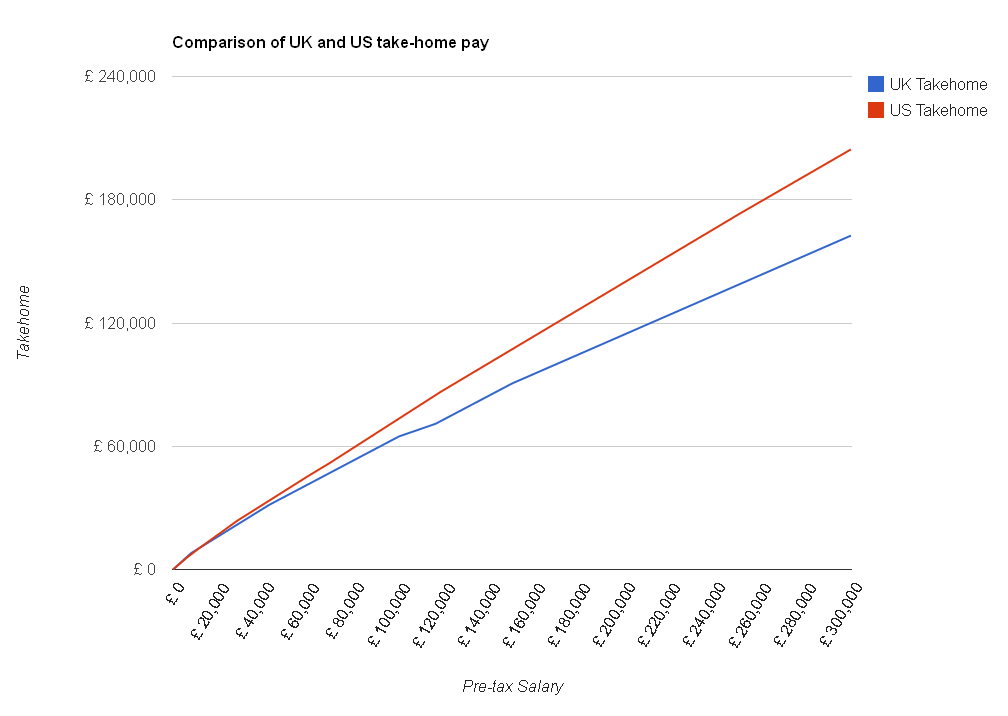

Comparison of UK and USA take home

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

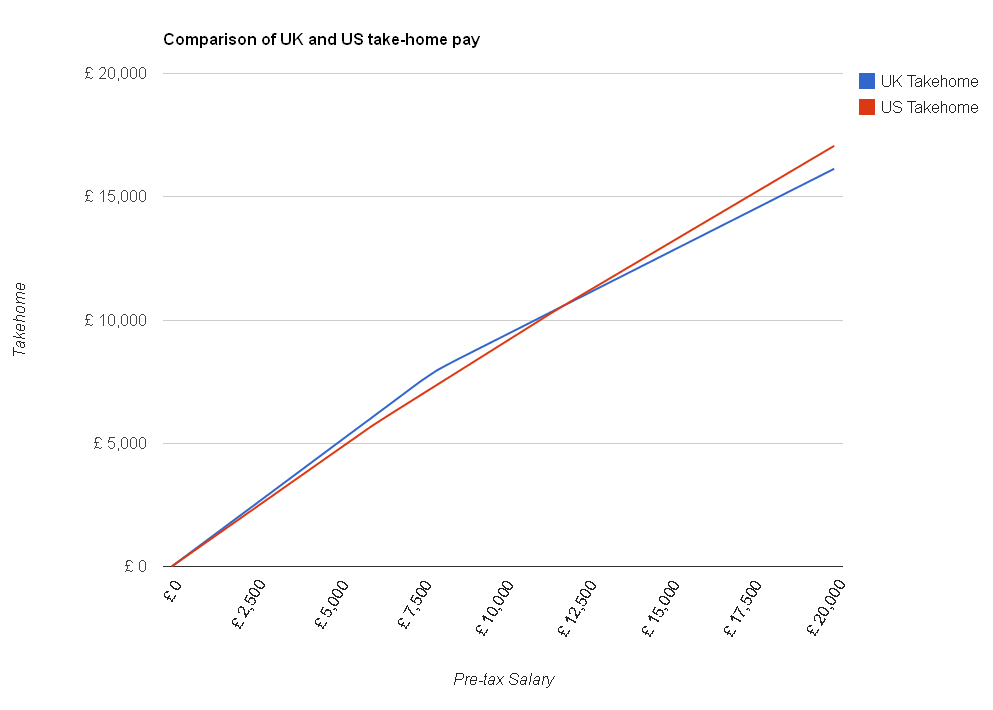

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

us

VAT

Sponsored Links

Archive

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009