Pensions

2014 Budget

Later today, the Chancellor will deliver his 2014 Budget to parliament, setting out his plans for the next few years. The Budget is the Chancellor’s opportunity to explain his policies and how they will affect the economy as a whole, and also what differences will be felt by ordinary members of the public.

He is likely to make much of the fact that the tax-free personal allowance (how much you can earn without paying income tax) has increased to £10,000 from April 2014, a coalition pledge delivered 1 year early. There is also talk that he might announce plans to raise the threshold for 40% tax (the amount at which you start paying income tax at 40% rather than 20%) in future years. This would probably lower the tax paid by those in middle management positions, say, and those in more senior roles.

The income tax and National Insurance rates which will take effect from 6th April 2014 have already been applied to The Salary Calculator, so you can easily see how your take home pay will be affected by the new tax year. You can also view a side-by-side comparison of 2013 and 2014 so you can see where the differences come from.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Salary sacrifice and personal pensions

For many years, The Salary Calculator has allowed you to enter a percentage of your salary to be deducted as contributions to a pension. However, only employer (or occupational) pensions have been supported. Now, the calculator has been updated to allow you to specify whether your contributions are to an employer pension (as before), a salary sacrifice scheme, or a personal pension.

These three different types of pensions have different regulations applied to them, which means they affect your take-home pay in different ways. Your income tax, National Insurance contributions and even student loan deductions might be different depending on the type of pension scheme you are paying into. More information about the different pension types is on The Salary Calculator “About” page.

Choose the “Pension” tab on The Salary Calculator to see the new options and see how it affects your take-home pay!

Childcare Vouchers added!

The Salary Calculator has been updated with a new option for Childcare Vouchers. Some employers offer employees the opportunity to have some of their pay in the form of vouchers which can be exchanged with accredited childcare providers instead of cash. These vouchers can be taken tax-free, saving the employee money.

Childcare vouchers are subtracted from your salary before tax and National Insurance, like pension contributions. However, there is a limit to the amount that can be taken tax-free each year – for the current tax year, this amount is £2,915. You can receive childcare vouchers above this amount, but you will not get the tax benefits. If you signed up for the voucher scheme before 6th April 2011, this limit applies no matter how much you earn. However, if you joined the scheme after this date and pay tax above the 20% Basic Rate, the amount you can receive tax-free is reduced. For those paying 40% tax (typically earning £42,475 or more), the tax-free allowance for childcare vouchers is £1,484 – and for those paying 50% tax (earning over £150,000) it is just £1,166.

To see how childcare vouchers can affect your take-home pay, head over to The Salary Calculator and enter your salary, along with the value of vouchers you receive each month. If you joined the scheme before 6th April 2011, tick the box to this effect. Enter the rest of your details and click Go! to see the results.

New – graphical representation of salary deductions

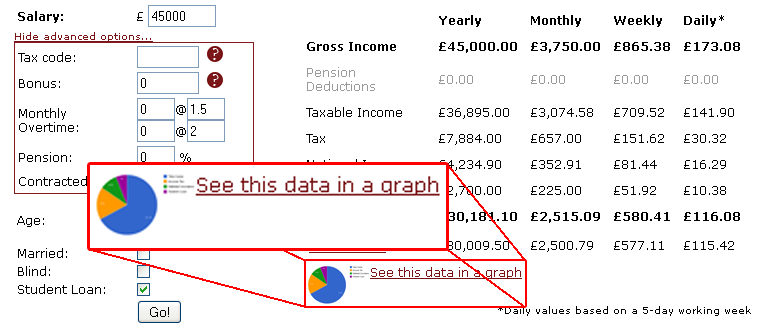

To help you to visualise where your income deductions are going, and how much of your money you get to keep (take-home pay), I thought I would add some pie charts to The Salary Calculator. Now, when you have entered your details and are viewing the table of results, there is an option to see a graphical representation of that information:

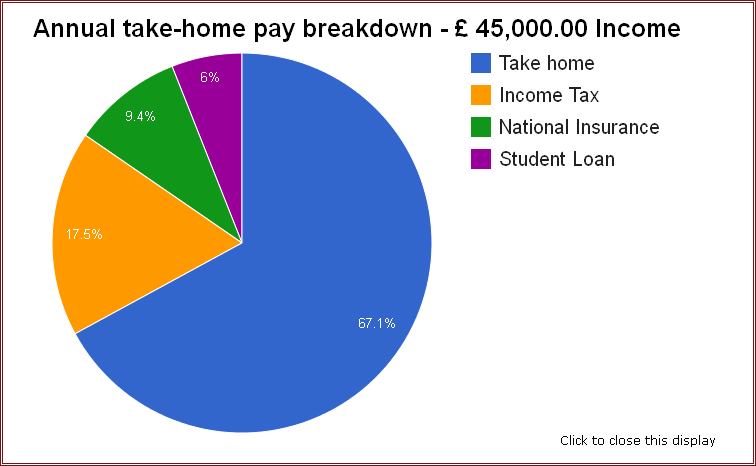

Click on this link, and an overlay will pop up, to show you an interactive pie chart that clearly explains where your money goes each year:

Of course, it will also show pension and student loan deductions if those apply to your calculations. To get started, head over to The Salary Calculator and enter your details. I hope you find this new tool useful – please use the comments section below to leave any feedback or suggestions for improvements.

Coalition pledges to affect tax

So we’ve got a new, coalition government and they have published the details of the agreements which were reached between the Conservative and Liberal Democrat parties. As you can see in the linked article, campaign pledges from both parties were included in the agreement, reflecting the compromises necessary.

They have promised that a new budget will be announced within 50 days, which will include changes to PAYE taking effect from April 2011. These changes will include increasing the income tax personal allowance to reduce taxes for low and middle earners (although not immediately the full increase to £10,000 the Lib Dems wanted), but the employee National Insurance threshold changes the Conservatives put in their manifesto will not be included. However Labour’s planned increase in employer National Insurance will not go ahead, pleasing Conservative supporters.

Full details will not be available until the promised emergency budget, but I promise to make available as soon as possible any relevant changes to The Salary Calculator!

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009