pound

Comparison of UK and USA take home

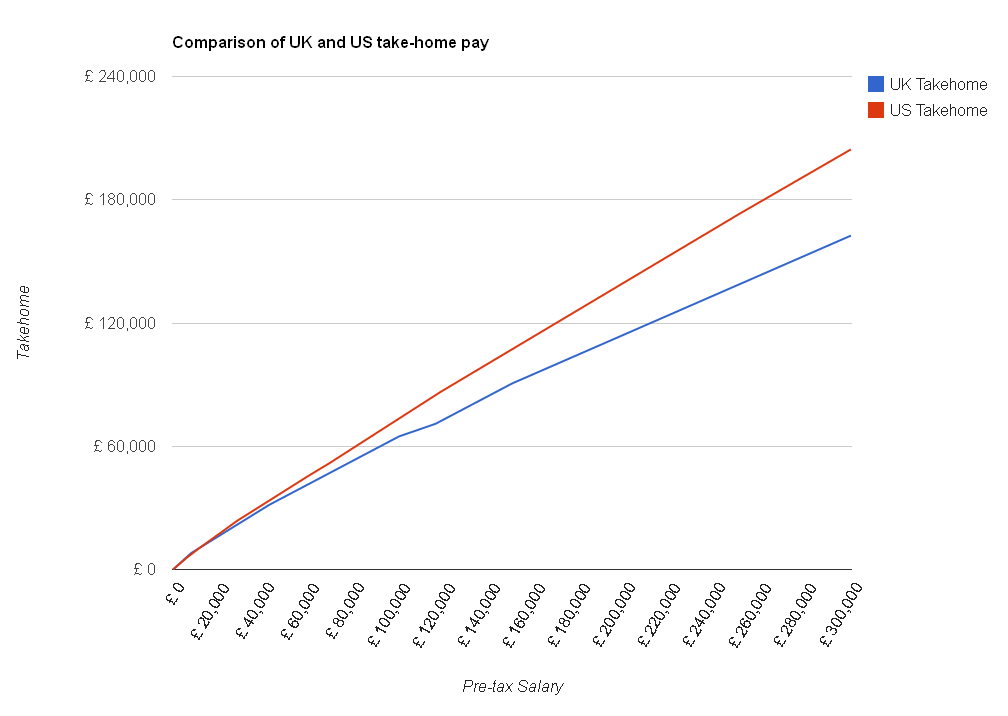

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

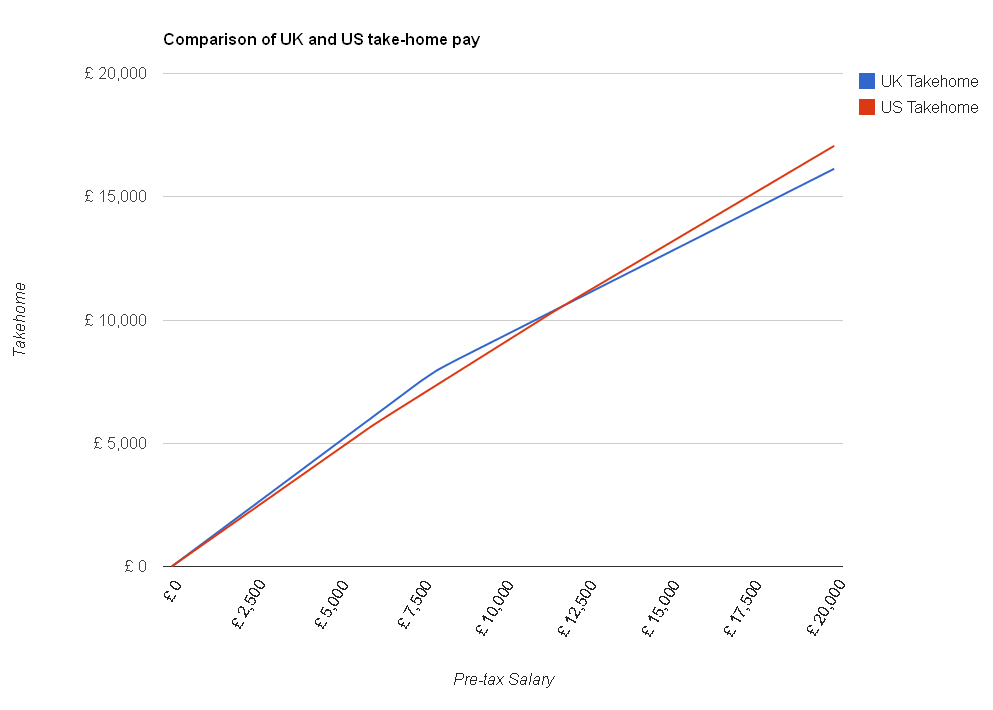

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Pound’s Euro rate improves

With the economy having improved over the last couple of months, and many people last year choosing to have a cheaper holiday and stay in the UK, perhaps this year there’ll be more of us thinking of treating ourselves to a trip to Europe this summer. And if you’re one of them, good news – over the last few weeks the Euro exchange rate has improved significantly!

Although €1.20 to the pound is not what you might consider a great rate, it’s not been at that level since the pound plummetted at the end of 2008. Unfortunately, it’s not all good news – this improvement is not due to the pound getting stronger but the Euro getting weaker – the pound continues to fall against the Yen and the Dollar (although it has seen a recent rally on this last count). The BBC’s Gavin Hewitt has written a great blog post explaining why the Euro is in such trouble.

When will the pound return to its previous strong position? Well, the rates we remember of a few years ago such as 2 dollars to the pound are not going to return anytime soon, but if confidence in the UK economy increases then investors will value the pound more. An increase in UK interest rates would also give a boost (since saving pounds then becomes more worthwhile) – but this would impact on mortgage interest rates for a lot of homeowners. Would you rather find it easier to pay your mortgage every month, or have a bit extra holiday money in the summer?

Election come down

So after all the hype and canvassing and the debates, the results are in – and it’s a hung Parliament, the first since 1974. What does that mean for your money? Well, first of all, the pound has fallen against other currencies – 4 cents against the dollar and 3 cents against the Euro – bad news if you were about to go on holiday!

Why is this? In short because the value of a currency is related to how confident investors are in a country’s economy. Historically, hung parliaments in Britain are unable to act as swiftly as majority governments, because consensus must be found by the members of coalition parties – who often disagree on certain principles. These delays in acting may hinder our recovery from the recession – so investors would rather not be holding on to the pound. Of course, if it does lead to a slow recovery (or even the “double dip” recession some analysts have been predicting), then this could continue to hit us in the wallet for months to come – with the effects of the recession continuing rather than abating.

Another area that was to be decided by this election was income tax and National Insurance. As I wrote previously, all the parties had set out in their manifestos their intended changes to the PAYE system. I put these all in the Election Comparison Calculator – which shows you want impact these differences would have on you. With no party yet in charge, it’s not clear what will happen about this – whose policies will be enacted? The Conservatives, who have the largest number of seats, said they would hold an emergency budget to implement some of their changes before next year. We’ll have to wait and see to find out what really happens.

UK economy turns around

So finally, the news we’ve been waiting for – the UK economy has come out of the longest recession since records began. In the 3 months to the end of December, the GDP (Gross Domestic Product) of the UK grew by 0.1%. This is only a very small growth, but it’s growth nonetheless – for the previous 6 quarters UK GDP had been shrinking.

This is a very encouraging sign, especially since the UK was one of the last major economies to still be in recession, others having returned to growth some months earlier. However – before we break open the champagne we should note that these are only preliminary figures – often GDP figures are corrected up or down at a later date, as explained here. Also, 0.1% is only a low growth rate and most analysts are predicting slow growth for the rest of 2010.

Still, after the recent turmoil a few quarters of good, solid, sustainable growth should stabilise the economy and see the job market (and mortgages and loans) pick up as confidence increases. A stronger national economy should also help the Pound make back some of its recent weakness against other currencies – although, again, this is likely to be a slow process.

Pound falling against the Euro

I have a trip to Paris coming up and it’s prompted me to check out the current exchange rate on the excellent X-Rates site. As you’ll see if you click on that link, Sterling has been falling over the last month or so.

As I wrote a few months ago, the Pound had improved both against the Euro and the Dollar during the summer months, which was good news for those of use on holiday there. It didn’t reach the highs of 2008, but it had improved since last winter. However, during August and particularly in September, a lot of the ground the Pound had made up was lost against both currencies. The pound is currently worth €1.09, from a high during the summer of €1.18, making travelling to Europe very expensive for us Brits.

I believe the reason for the Pound’s decline is the fact that the UK is still in recession whereas the powerhouses of Europe, Germany and France, have successfully grown their economies. Hopefully we will see in the next few months Britain exit from recession, and then the Pound will become a more attractive currency for investors, making it stronger and (importantly) worth more.

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009