tax rates

Budget 2013

In yesterday’s budget, the Chancellor George Osborne outlined his plans for the next couple of years. In terms of take home pay from April onwards, there were no real surprises – the personal allowance has been increased and the top “Additional rate” tax has been reduced from 50% to 45%. In an earlier blog post I have described how these changes have been applied to The Salary Calculator.

Those who are repaying their student loan could be saving as much as £50 next year, as the threshold for repayment has increased from £15,795 to £16,365 – so the deductions from their salary will be less from April. However, the flip side of this is that because less of the loan is being repaid, it will take longer for the loan to be paid off in full and therefore will cost more in the long term.

What I found most interesting about the Chancellor’s announcements yesterday was the extension of an existing scheme for people buying their first house (FirstBuy) to allow more people to take part. The new scheme is called Help to Buy, and will help people to buy a new-build home with a 5% deposit, even if they can’t get the rest of the 95% from a mortgage lender. The government will provide a loan (interest-free for 5 years) for up to 20% of the value of the house, leaving buyers to find only 75% from a mortgage lender. In return, the government will get a share of the equity in the house – so if the house price increases, the amount repayable when the house is sold will increase at the same rate. This scheme is available to first-time buyers and to people who are already on the housing ladder – it does not have to be your first house purchase – and the value of the house can be up to £600,000.

There is also a scheme to help people buy houses which are not new-built, where instead of providing some of the money, the government will guarantee some of the mortgage so that if the buyers default, the lender gets some of the money from the government. This is aimed at encouraging lenders to allow people with small (5%) deposits to borrow.

If it takes off, this scheme has the potential to help people who are currently struggling to buy a home because they don’t have a large enough deposit. It may also help to stimulate the house construction industry, and bolster a flagging property market. The treasury has provided an infographic with some details.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

April 2013 tax rates applied to The Salary Calculator

The Salary Calculator has been updated with the latest income tax and National Insurance rates from HMRC which will take effect from 6th April 2013. Although for the moment the current 2012/13 tax year will be applied to calculations by default, you can choose the 2013/14 tax year from the drop-down box to see what your pay slip will look like later this year. You can also see a summary of the 2013/14 values under the normal results, and there is a special Comparison page where you can see 2012 and 2013 side-by-side.

The biggest changes for most people will probably be:

- Tax-free personal allowance increased from £8,105 to £9,440

- Student Loan repayment threshold increased from £15,795 to £16,365

- Additional rate tax for those earning over £150,000 reduced from 50% to 45%

- Over-65 and Over-75 personal allowances not increased

The last of these points was called the “Granny Tax” by detractors when it was first announced, although it is not actually an introduction of a new tax. Previously, those over 65 and over 75 had larger tax-free personal allowances which, like the Under-65 allowance, was increased each year. From April 2013, these allowances will no longer be increased each year and will remain at their current values of £10,500 and £10,660 respectively – until the Under-65 allowance catches up with them. Also, these allowances will no longer be applied to people reaching the qualifying age – only those who were born before 6th April 1948 (or 6th April 1938 for the upper allowance) will receive these allowances. Those reaching these threshold ages after 6th April 2013 will not receive the additional allowance.

Those who are fortunate enough to be earning more than £150,000 will see their tax rate on income over that limit reduced from 50% (where it has been since this tax was introduced in April 2010) to 45%. You might think that, with personal allowances going up and tax rates coming down, everyone will be better off from the start of the new tax year. However, there is a set of people who will find that they pay more tax in the 2013/14 tax year than they did in the 2012/13 tax year, due to a rule which applies to those earning over £100,000.

If you earn more than £100,000 in the year, the tax-free personal allowance is gradually reduced at a rate of £1 for each £2 you earn over the £100,000 limit. Those earning £118,880 or more in 2013/14 will therefore have no tax-free allowance. Because the threshold between 20% and 40% tax has been reduced, those who earn between about £117,000 and £157,000 will find that they actually pay more tax than they did the year before – when those earning less and those earning more will each pay less than they did the year before.

If you want to see how the April 2013 income tax rates will affect you, you can get started with The Salary Calculator or try the 2012 / 2013 Income Tax Comparison.

New – choose your tax year!

The Salary Calculator has (finally!) been updated so that you can choose to view calculations for different tax years. You will see that there is now a drop-down box in which you can choose the tax year that should be applied. By default, the current 2012/13 tax year will be selected so if you just want to see current values you do not need to do anything.

Details for previous tax years going back as far as the 2005/6 tax years have been made available, so you can see how your take-home pay has changed over the years. You may have forgotten how the personal tax-free allowance has increased over the past few years, which gives you more to take home – or perhaps you’d just like to see how far your salary would have gone a few years ago.

I do plan to add more past years (i.e. before the 2005/6 tax year) to The Salary Calculator, and of course, when the details of 2013/14 and further forward become available, they will be added to the site. Head over to The Salary Calculator to try it out. Please let me know in the comments below if you find this option useful or not!

What would a 30% flat tax be like?

Earlier this month, the 2020 Tax Commission published a report promoting replacement of our current income tax system, which has varying rates of tax (from 20% to 50%) and National Insurance (typically 12% and 2%), with a simpler system which has a single flat tax at a rate of 30%. They also recommended raising the personal allowance (the amount you can earn tax-free) to £10,000 per year, from its current £8,105.

I thought it would be interesting to see how this plan, if implemented, would affect us when we get paid each month. The following chart compares the April 2012 tax rates in blue with the simplified version in red:

As you can see, under this proposal everyone who currently pays tax on employment would take home more money each month, as the total amount due would be less. The 2020 Tax Commission say that as part of this plan, schemes that currently allow people to take income through a business, avoiding National Insurance, would be removed. This might mean that people who are using such schemes to avoid tax at the moment would pay more under the proposal.

But, as you’ve probably realised, if (almost) everyone is paying less tax, that means the Government will get less money. This is indeed true – the gap between the two lines on the chart represents how much less the Government would get each year – and the commission also recommend abolishing inheritance tax and similar taxes, which would further reduce Government income. This would mean further cuts in public spending – which would be difficult to swallow at the moment. More reaction on the report is in this useful BBC article.

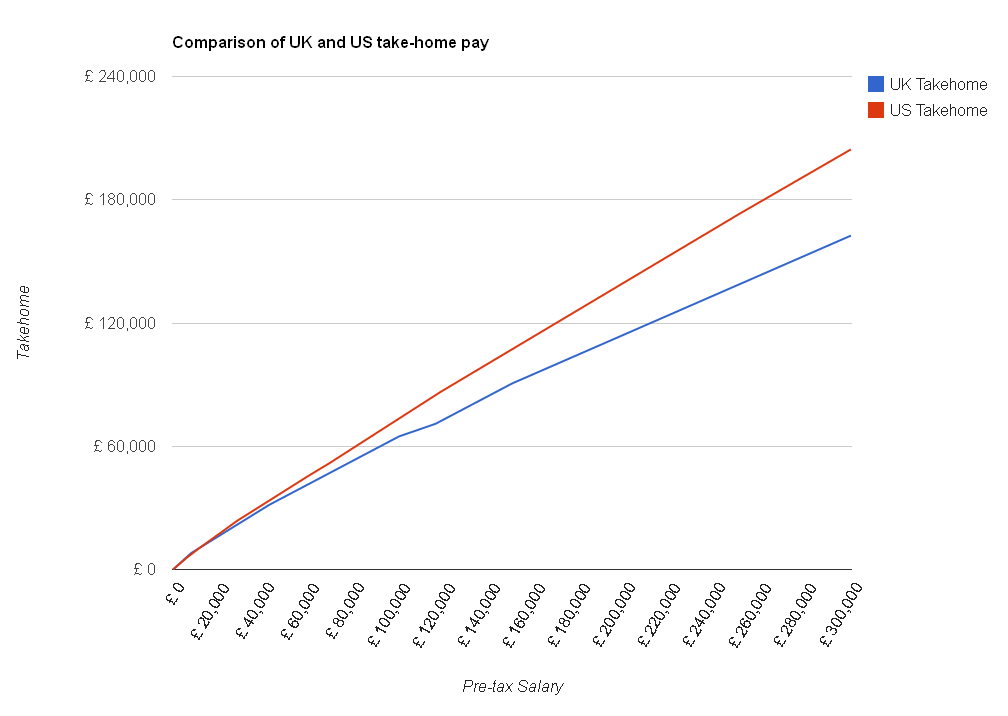

Comparison of UK and USA take home

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

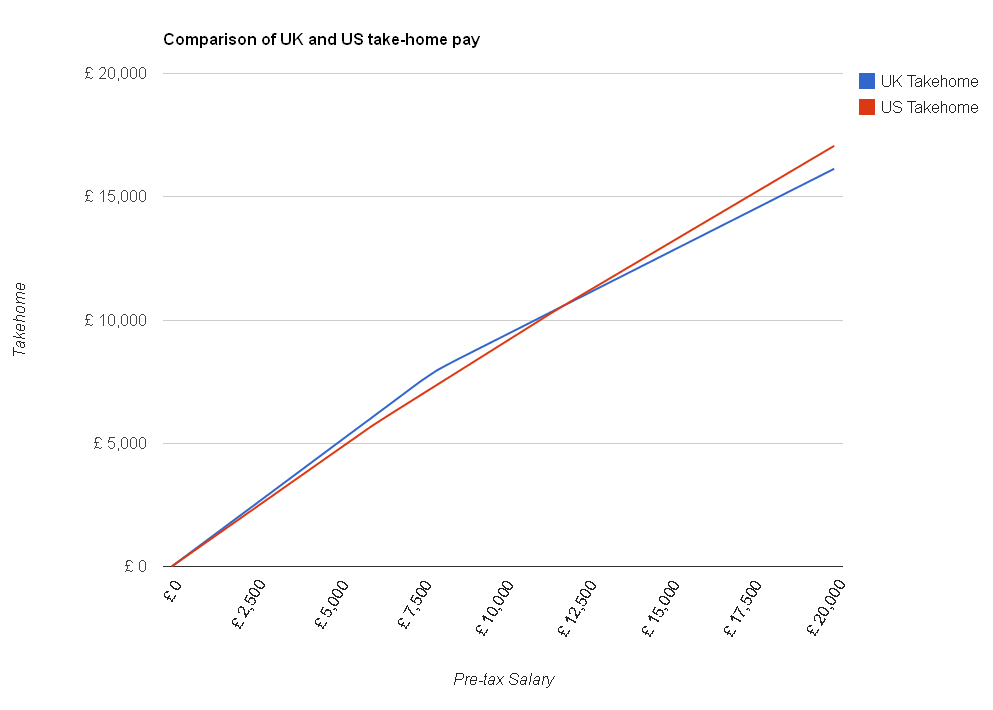

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009