united states

Updates for USA tax changes

Over the New Year period I was in the USA, watching with interest as the government there tried to resolve their tax and spending problem that was called the “fiscal cliff”. This cliff was due to the fact that many of their tax laws were due to expire at the end of 2012 and they had not yet agreed how to proceed for 2013. Tax years in the USA are the same as calendar years, starting on 1st January, so it was important that they reached a conclusion over the holiday period.

There is a US version of The Salary Calculator, and so I needed to know how to update it for 2013. Unfortunately, when the answer came, it wasn’t simple and it wasn’t very clear, either. As well as changes to some of the tax rates (including an increase for the top rate from 35% to 39.6%), there was an additional Medicare (health care) tax of 0.9% on those earning over $200,000 ($250,000 for married couples). There was also the re-introduction of old regulations which reduce the amount you can deduct before tax – Personal Exemption Phaseout (PEP) and “Pease” (reduction of pre-tax deductions named after the congressman who created it). PEP is similar to the personal allowance reduction which occurs in UK tax if you earn over £100,000 and applies to those earning more than $250,000 ($300,000 for married couples). Pease reduces pre-tax deductions such as charitable giving for those earning more than these same thresholds. The overall effect is to increase income tax revenue, largely from the upper middle class and the wealthy.

As well as applying these tax changes to The Salary Calculator, I also had to include something called Alternative Minimum Tax, which is used to make sure that taxpayers don’t use so many deductions and loopholes to reduce their tax burden below a certain percentage of their income. This had been in effect for a few years but was rising in prominence and the number of taxpayers it affects, so I was overdue in adding it.

All of this led to a significant amount of work, not least in finding reliable figures for the thresholds and rates which apply to all of these for 2013. Even though I believe I have found the latest ones, the US government is meeting again later in the year to discuss tax plans again, and it is possible that these figures or rules may even be changed again – if this happens I will update the US Salary Calculator with the latest information. To learn more about the tax calculations, see this page about the US Salary Calculator.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

Comparison of UK and USA take home

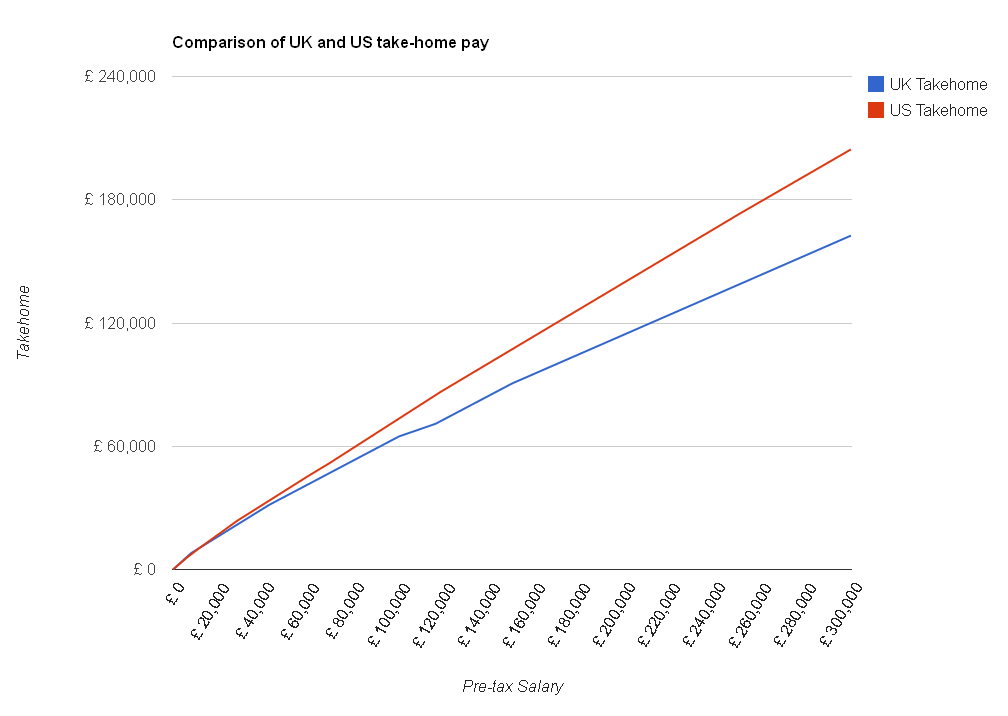

You may not know that there is a US version of The Salary Calculator which calculates take-home pay after income tax and Social Security (which is like the UK’s National Insurance). I thought it would be interesting to see how much of their salary our American cousins get to keep compared with how much we get to hold on to over here. I used an exchange rate of $1.59 to the pound, and the 2012 tax rates for both countries, to create this chart:

As you can see, in most cases the Americans get to keep more of their hard-earned cash than we do. The top rate of federal income tax is 35% in the USA, and they only start to pay that if they earn more than $398,100 in a year – compared with 40% tax in the UK if you earn more than £42,475 and 50% if you earn more than £150,000. Also, Social Security is charged at 5.65% of most incomes, compared to National Insurance which is calculated at 12% (although only above income of £7,605 per year). You might have heard in the news some people saying that the 50% tax rate makes Britain unattractive for wealthy business people – this is what they are talking about – if you could run the same business in the USA and pay tens or hundreds of thousands less in tax each year, you’d think about moving – making any British employees you have redundant and employing Americans instead.

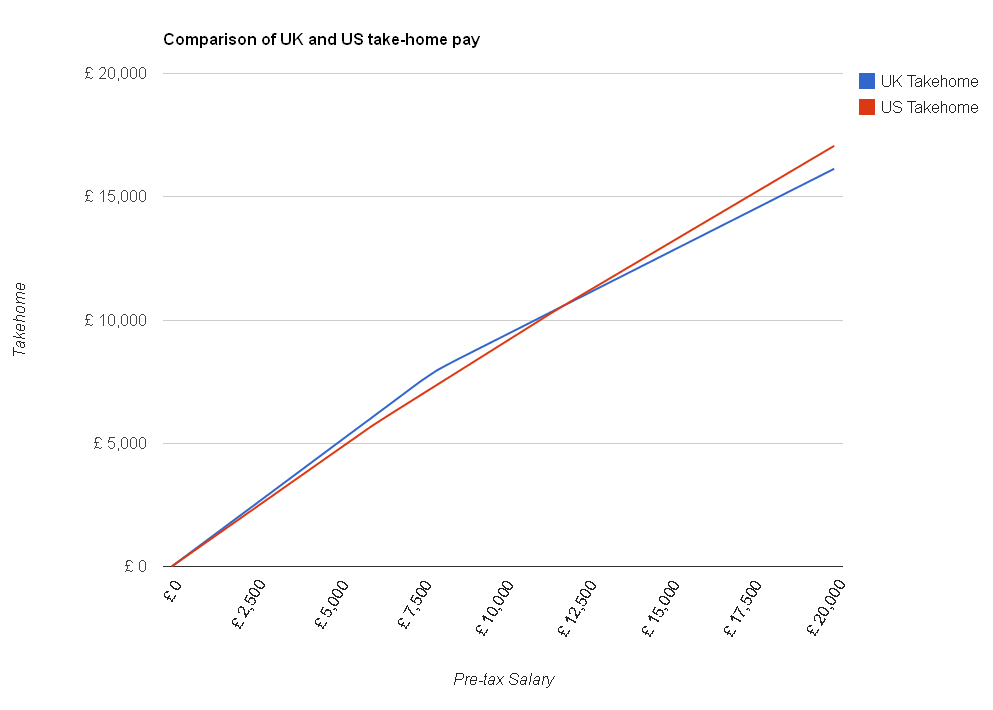

However, before you start packing your bags, there are a few other things to consider. Firstly, you can see from this zoomed-in version of the chart that if you earn less than about £12,000 per year, you actually get to keep more of it here in the UK than you would in the US:

Also, these calculations only include federal income tax and Social Security – most of the states charge separate income tax on top of what the central government takes, which The Salary Calculator doesn’t currently work out. Another consideration is that in the UK we can rely on the NHS to provide us with healthcare if we need it either for free or for a relatively small prescription charge, but in the USA health insurance can cost thousands of dollars per year.

Also, it can be difficult to get a decent cup of tea.

You can read more about US tax rates on The Salary Calculator (US).

US tax can be complicated for same-sex couples

I was in the USA recently and was interested to see an article in the newspaper USA Today reporting that same-sex couples sometimes face extra difficulties when it comes to paying their taxes. In the US, although there is an equivalent to PAYE (where your employer deducts your tax for you), almost all taxpayers complete a tax return detailing their income, allowable deductions, and the tax they should pay. This might be more or less than what your employer deducted, so you may have to pay the difference or request a refund.

The problem for same-sex couples occurs because of two details of the American tax / legal system. Firstly, married couples can file a joint tax return, rather than filing two separate returns. Filing a return can be a laborious process, and sometimes it is necessary to pay a tax consultant to complete it for you, so filing only one can save time and money. Sometimes, filing a joint return actually leads to less tax being owed, an obvious benefit. Secondly, same-sex marriage is not recognised by the federal government (i.e. the country) but is recognised by some states (e.g. Massachusetts). What this all adds up to is same-sex couples having to file different tax returns at the state and federal levels – a joint return for their state (if it allows them to submit joint returns) and separate returns for the federal government. This can cost couples more in tax consultant fees (as there are more forms to submit) and can cost them more in tax as they miss out on the tax benefits of being a married couple.

At the moment it doesn’t appear that this problem is going to go away – not soon, in any case. You can learn more about US Federal Income Tax on the US Salary Calculator.

Pound’s Euro rate improves

With the economy having improved over the last couple of months, and many people last year choosing to have a cheaper holiday and stay in the UK, perhaps this year there’ll be more of us thinking of treating ourselves to a trip to Europe this summer. And if you’re one of them, good news – over the last few weeks the Euro exchange rate has improved significantly!

Although €1.20 to the pound is not what you might consider a great rate, it’s not been at that level since the pound plummetted at the end of 2008. Unfortunately, it’s not all good news – this improvement is not due to the pound getting stronger but the Euro getting weaker – the pound continues to fall against the Yen and the Dollar (although it has seen a recent rally on this last count). The BBC’s Gavin Hewitt has written a great blog post explaining why the Euro is in such trouble.

When will the pound return to its previous strong position? Well, the rates we remember of a few years ago such as 2 dollars to the pound are not going to return anytime soon, but if confidence in the UK economy increases then investors will value the pound more. An increase in UK interest rates would also give a boost (since saving pounds then becomes more worthwhile) – but this would impact on mortgage interest rates for a lot of homeowners. Would you rather find it easier to pay your mortgage every month, or have a bit extra holiday money in the summer?

Superfreakonomics

I’ve previously mentioned the book Freakonomics as an interesting read which explains how economic thought can be applied to many different (and unusual) areas of the world around us. Well, the same authors (Steven D. Levitt and Stephen J. Dubner) have recently released a follow-up book, Superfreakonomics.

This book covers in quite some depth topics such as finding solutions to global warming, using statistical analysis to find terrorists (particularly relevant at the moment) and why the solutions to big problems are often simple. I personally found that a few of these chapters strayed further from the economics-based descriptions that defined the first book – concentrating more on the details of possible solutions to global warming than the economic forces working on those solutions, for example.

Having said that, the chapter about the economics of prostitution is very much like the previous book’s chapter on drug dealing – because the relevant studies the authors were reporting on were done by the same researcher. It offers some of the detailed analysis that I felt made the first book accessible – explaining why the data gathered (and the methods used to gather the data) can tell you things you wouldn’t otherwise find out.

A very entertaining read which unfortunately is over too quickly – but the epilogue is my favourite part of the whole book, where they explain briefly the impact of explaining to monkeys the concept of money!

Click on the link to the right to buy the book from Amazon, and you’ll be doing your bit to support this site!

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009