About The Salary Calculator

Budget 2012 update

Today, the Chancellor gave his annual budget speech in the House of Commons, outlining government spending plans for the next couple of years. The details of income tax and National Insurance from 6th April 2012 had already been provided, so as I have explained in a previous post, The Salary Calculator is up to date with the latest tax information.

However, the Chancellor took the opportunity to outline plans for income tax from April 2013, and there will be a few changes. Firstly, the under-65 tax free allowance will be increased from April 2013 to £9,205, in line with the coalition pledge to increase the tax-free personal allowance to £10,000 before the next election. This is an increase of £1,100 on the April 2012 value, saving those on low and middle incomes up to £220 per year. However, the increased personal allowances currently available to those over 65 will be frozen and, for those not yet receiving the increased allowances, replaced by a single allowance for all ages (although this change will not take immediate effect).

Another change in 2013 will be to reduce the top rate of income tax, paid by those earning over £150,000 per year, from 50% to 45%. The 50% rate was introduced by the Labour government, where previously such income would have been taxed at 40%. This will be popular with traditional Tory voters but Labour are complaining that the richest are getting tax cuts in this time of austerity.

The Salary Calculator will be updated with the April 2013 values nearer the time – in the meantime, you can see what the April 2012 changes will make to your pocket each month by checking The Salary Calculator 2012. There is also a comparison utility so you can easily see the difference between 2011 and 2012.

None of the content on this website, including blog posts, comments, or responses to user comments, is offered as financial advice. Figures used are for illustrative purposes only.

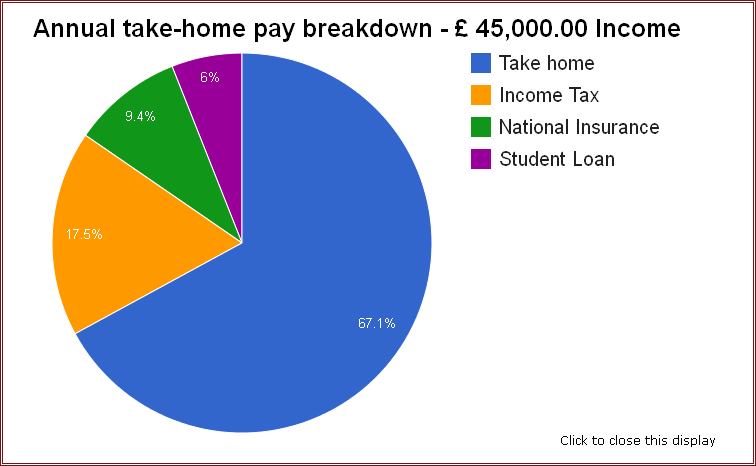

New – graphical representation of salary deductions

To help you to visualise where your income deductions are going, and how much of your money you get to keep (take-home pay), I thought I would add some pie charts to The Salary Calculator. Now, when you have entered your details and are viewing the table of results, there is an option to see a graphical representation of that information:

Click on this link, and an overlay will pop up, to show you an interactive pie chart that clearly explains where your money goes each year:

Of course, it will also show pension and student loan deductions if those apply to your calculations. To get started, head over to The Salary Calculator and enter your details. I hope you find this new tool useful – please use the comments section below to leave any feedback or suggestions for improvements.

Modifications to the Salary Calculator design

Firstly, apologies for the long wait since the last update on the Salary Calculator blog. It’s been a busy summer and now the autumn is keeping me active, too!

However, I have been able to spend some time making minor alterations to the way The Salary Calculator is displayed in some browsers. The original site was built at a time when few computers had widescreen or high-resolution monitors, which is now not the case. When users with widescreen monitors viewed the old layout, bits of the site were displayed very far apart, making it difficult to use.

The new layout is fixed to a width that should be accommodated by almost all browsers, and should provide a better experience to those on widescreen monitors. I would really appreciate any feedback on how the new layout is working for you. At a later date, I’d love to improve the site design further, and to add those extra features you have all asked me for.

Bonus payments added!

As requested by a large number of visitors to the site, The Salary Calculator has been updated to allow you to enter bonus payments. If you might earn a bonus from your employer one month, you can now use the calculator to see what kind of a difference it will make to your payslip that month.

Bonuses are typically paid as a one-off extra on top of your usual salary. Your employer will work out what extra deductions (tax, National Insurance and Student Loan) will be required that tax year because of this extra payment, and will add these on top of your usual deductions for that month. Yes, this unfortunately means that you’ll pay a lot of tax, NI and Student Loan that month (boo!) – but some of your bonus will be left for you to enjoy!

For the purposes of displaying the information The Salary Calculator assumes that your salary is normally paid monthly, and shows you what a bonus month would look like compared to a normal month. Similar calculations will be done by your employer if you are paid weekly. To get started, click here to check out The Salary Calculator with bonus payments.

April 2011 rates applied

The April 2011 tax and National Insurance rates have been applied to The Salary Calculator.

In comparison to last year, when rates for most of us were unchanged, there are a number of differences which will mean that your payslip will be different next month.

The standard personal allowance (the amount you can earn tax-free) is increasing by a thousand pounds to £7,475, but this is mitigated in some way for higher earners by the threshold for 40% tax being lowered to £35,000. Similarly, NI rates increased by one penny in the pound (to 12% and 2%) but the threshold for paying NI increased so lower earners may not be too badly affected.

To see how you’re affected, try out The Salary Calculator with your salary. The details of the figures used by The Salary Calculator are available on the About page.

Useful links:

Categories

Tags

-

50% tax

2022

April 2010

April 2011

April 2012

budget

coronavirus

cost of living

cost of living crisis

covid-19

debt

dollar

economics

Economy

election

Employed and Self Employed

Foreign Currency

foreign exchange rates

HMRC

holiday

holiday money

house prices

houses

income tax

interest rates

Jobs

Loans

Mortgages

national insurance

Pay As You Earn

pension

Pensions

personal allowance

pound

recession

recovery

savings

Self Assessment

self employed

self employment

student loans

tax rates

The Salary Calculator

unemployment

VAT

Sponsored Links

Archive

- June 2025

- May 2025

- April 2025

- March 2025

- November 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- November 2019

- September 2019

- April 2019

- March 2019

- December 2018

- April 2018

- March 2018

- January 2018

- May 2017

- March 2017

- February 2017

- September 2016

- June 2016

- March 2016

- February 2016

- January 2016

- June 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- July 2014

- June 2014

- May 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- May 2011

- April 2011

- March 2011

- January 2011

- December 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009